Table of Contents

In the Philippines, coal is far more than a fuel — it is the backbone of the nation’s energy system as the country grapples with rising power demand and expanding economic activity. The International Energy Agency (IEA) forecasts that the Philippines’ coal demand will rise by 15% by 2030, reaching about 54 million tons, keeping it among Southeast Asia’s top coal consumers alongside Indonesia and Vietnam.

This growing demand stems from robust economic and population growth, coupled with a projected 27% increase in electricity consumption over the forecast period. In 2025, coal consumption was expected to have reached about 47 million tons, underscoring how much the energy system still relies on fossil fuels to keep the lights on.

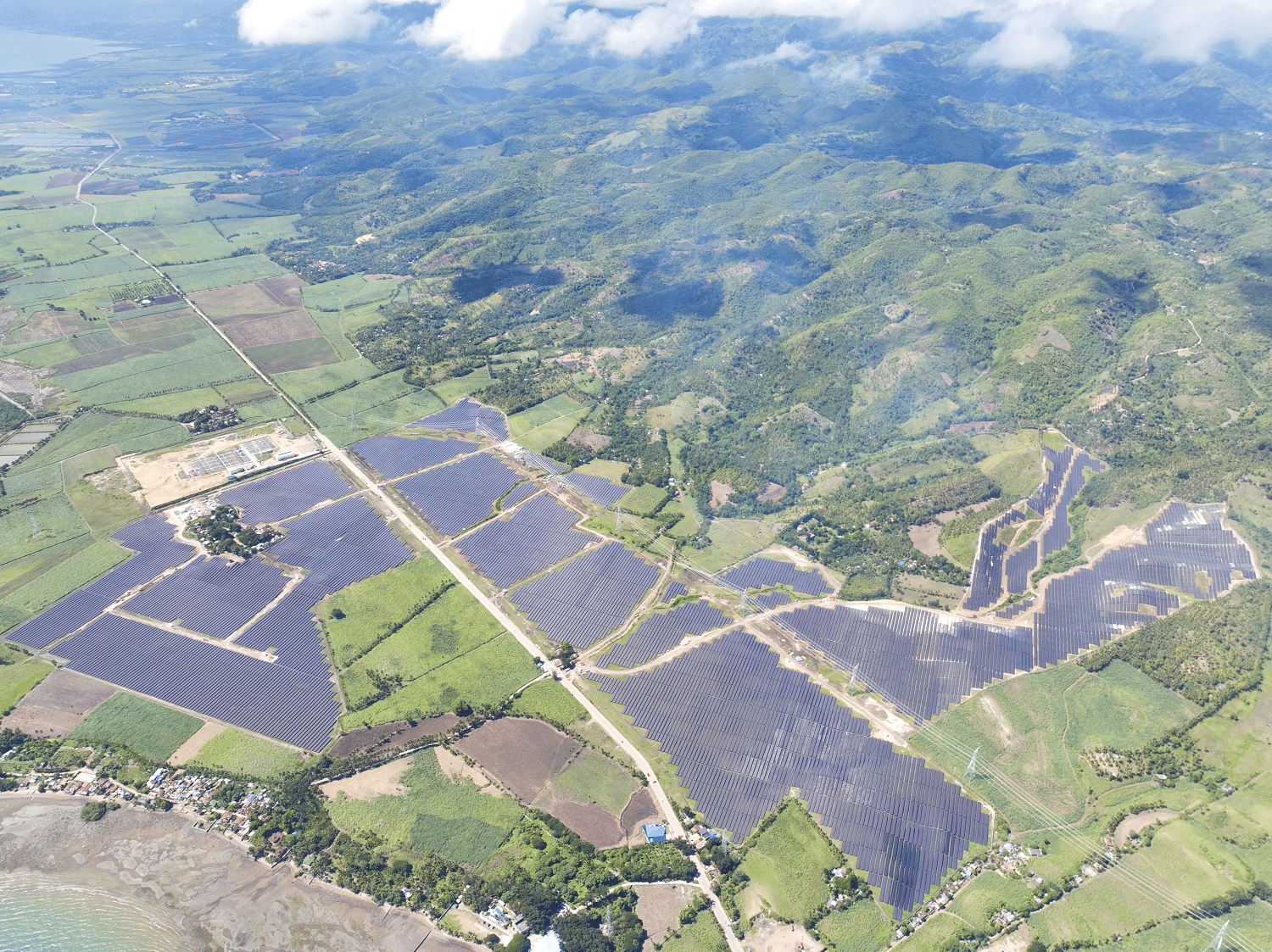

Today, coal dominates the power generation mix, accounting for around 63% of the country’s electricity, while renewable sources only make up about 22%. That heavy share underscores a key challenge for policymakers: while renewable capacity continues to grow, it has yet to scale sufficiently to replace coal’s dependable baseload role.

Moreover, the inherently intermittent nature of wind and solar generation can strain grid reliability. This is a risk highlighted by the widespread power outage in Spain and Portugal in 2025, which exposed the difficulties of managing sudden swings in renewable output during periods of high penetration.

(Also read: From Solar Ambitions to Scrutiny: The Rise and Reckoning of Leandro Leviste)

Coal to keep up with growing demand

The IEA has cautioned that growth in renewable generation is expected to lag behind the Philippines’ rising electricity demand in the near term.

Coal remains such a mainstay because its technologies provide continuous, around‑the‑clock electricity, unlike solar and wind, which are unreliable unless paired with costly storage systems. A PhilStar article states that “Coal-fired power plants are typically regarded as the cheapest among the scheduled base load generation facilities that can operate continuously and provide consistent power to meet the base demand of the grid.”

Even the Department of Energy (DOE) recognizes coal’s vital role in the country’s energy mix. “Just because we are pushing for renewable energy (RE), doesn’t mean that we want to abandon baseload. Baseload can be coal, it can be gas, it can be hydro, geothermal,” explained DOE Secretary Sharon Garin. “That is the steady, not intermittent. So, we want to push for that. RE is a good source of energy, but it will not be enough.”

Because of this, the agency expanded exemptions to the 2020 coal moratorium because “the phasing out of coal has to be very well calibrated.” In October 2025, new exemptions were announced, including coal projects for self-generation in industrial zones, off-grid facilities, mining operations producing critical minerals, and on-grid plants deployed only in cases of imminent power shortages.

The decision drew praise from industry leaders. DMCI Power Corp., led by Isidro Consunji, welcomed the move, noting it addresses the concerns of small power utilities excluded from the coal moratorium. Consunji described the exemptions as “practical and economically sound.”

Meralco PowerGen (MGen) also supported the DOE’s approach, highlighting its balance between advancing the energy transition and maintaining supply reliability. MGen President Emmanuel Rubio said the policy’s limited exemptions reflect “the need for dependable baseload power in regions still facing transmission and supply constraints.”

Moreover, Bienvenido Oplas of the ADR Stratbase think tank argued that maintaining a significant share of baseload generation from coal has helped temper electricity price volatility in the country, especially when reserve margins tighten, and spot market rates spike.

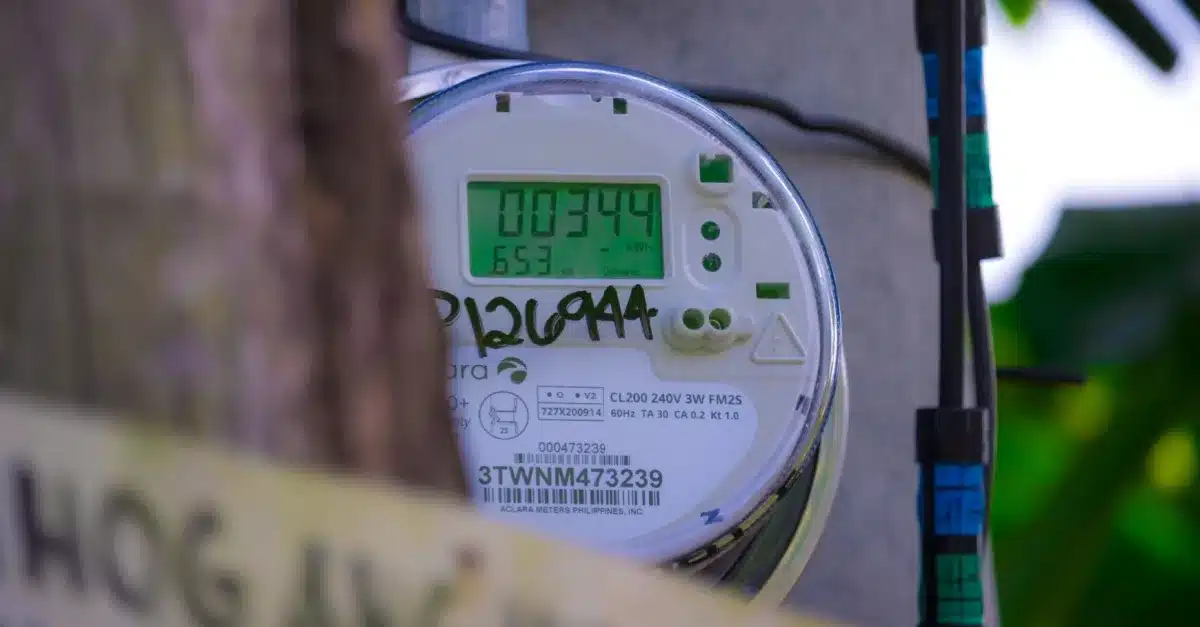

In regions like Cebu, where economic growth puts pressure on demand, reliable coal‑fired power has underpinned a steadier supply of price‑competitive kilowatt‑hours, which in turn helps keep household power bills from bouncing sharply and eases overall cost‑of‑living pressures tied to electricity costs.

Oplas also emphasized that while renewable energy is important for lowering long‑term averages, its intermittent nature means it must be paired with dependable baseload capacity to avoid price shocks and outages that can feed into higher costs for households and businesses. “The real energy transition we should work for is from unstable, blackout-friendly, and expensive energy to abundant, stable, cheap energy in order to achieve lower inflation and higher growth,” he asserted.

(Also read: Power Rates Seen to Rise as WESM Prices Surge in December)

Coal’s continued importance worldwide

While the Philippine context vividly illustrates coal’s present necessity, the global energy landscape paints an even larger picture of coal’s enduring role.

Recent data from the IEA highlights the challenge of meeting rising electricity demand while expanding renewable energy. The report shows that coal-fired power has remained remarkably resilient, even as countries pledge to reduce carbon-intensive fuels. Across the Organization for Economic Cooperation and Development (OECD), coal generation rose 4.3% year-to-date in 2025, offsetting declines in natural gas, which fell 1% over the same period. In September 2025 alone, natural gas generation dropped 1.5%, while coal increased 2.8%.

However, the trend varies sharply by region. OECD Europe cut coal output by 10.2% in September, reflecting strong policy-driven efforts to reduce reliance on solid fuels. In contrast, coal use in the Americas and Asia-Oceania rose more than 6%, fueled by industrial demand and the need to replace expensive or limited gas supplies.

In the first half of 2025, China commissioned 21 gigawatts (GW) of coal-fired power, the largest total for that period since 2016,according to the Center for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM) in their biannual review of Chinese coal projects. Full-year projections suggest coal capacity additions could surpass 80 GW. While China leads the world in renewable energy installations, it remains a dominant player in coal power, driving record-high global demand.

CREA and GEM attributed the surge to the wave of permitting in 2022 and 2023, when China approved more than 100 GW of coal capacity each year, averaging roughly two new plants per week.

In the first half of 2025 alone, 25 GW of coal projects were newly permitted, but combined new and revived projects totaled 75 GW. Construction starts and restarts reached 46 GW, roughly equivalent to South Korea’s entire coal power capacity.

In Australia, the planned retirement of coal-fired power plants is raising concerns about grid reliability. The Australian Energy Market Operator (AEMO) says current closure timelines and the delivery of replacement resources are misaligned, creating risks as the National Electricity Market (NEM) shifts from large baseload generation to firmed renewables.

To address the gap, AEMO has proposed extending the required notice for coal plant closures from 3.5 years to five years, giving operators and regulators more time to plan, approve, and commission replacement generation and grid-stabilizing resources.

The extended notice would also align coal exit planning with Network Support and Control Ancillary Services (NSCAS) gap declaration schedules. AEMO warns that without such measures, rapid coal retirements could strain the NEM even as Australia accelerates its renewable energy transition.

Meanwhile, a report by the Institute for Energy Research, titled “Blue States, High Rates: Electricity Prices—Elections Have Consequences,” compared electricity costs in five U.S. states: California, New York, Florida, Louisiana, and Kentucky. The analysis shows a clear divide between states pursuing aggressive renewable policies and those relying on fossil fuels.

California and New York, which have positioned themselves as climate leaders, have pushed to expand renewables and cut fossil fuel use. California, for example, generates 42% of its electricity from natural gas, 39% from non-hydro renewables, 12% hydro, and 7% nuclear. Its electricity rates are the second-highest in the nation, roughly double the national average, driven in part by policies such as carbon mandates, renewable targets, nuclear closures, net metering, and electric vehicle (EV) subsidies.

In contrast, Florida, Louisiana, and Kentucky maintain lower electricity costs by continuing to rely on fossil fuels. Louisiana’s electricity is 73% natural gas, giving it the third-lowest rates in the U.S. Florida produces 75% of its power from natural gas, keeping rates 2% below the national average despite importing most of its fuel. Kentucky relies on coal (67%) and natural gas (26%), resulting in the lowest rates east of the Mississippi, 21% below the national average, without imposing costly carbon or renewable mandates.

Why a rapid renewable push may harm the PH

For the Philippines, a headlong rush to replace coal and other fossil fuels with renewables could be more harmful than helpful. Experience abroad shows that aggressive renewable policies often come with higher electricity prices and greater volatility, creating economic strain for households and businesses.

Moreover, unlike major emitters such as China, the Philippines contributes only 0.5% of global greenhouse gas emissions. Pushing the Philippines toward a strict “net-zero” target risks being counterproductive. On a global scale, the country’s emissions are so small they barely register; its coal plants do not cause the typhoons or extreme weather that batter the archipelago. Even if the Philippines were to eliminate every ton of fossil fuel emissions tomorrow, it would make no measurable difference to the planet’s climate.

Yet the pursuit of an immediate, wholesale shift to renewable energy carries real costs at home. Policies that demand rapid decarbonization could drive up electricity prices, destabilize the power supply, and slow economic growth — the very growth the Philippines needs to strengthen resilience and adapt to climate threats. In short, net-zero ambitions imposed prematurely risk sacrificing development and energy security for a climate impact that the country has little ability to influence.

A Daily Tribune editorial warns that scaling renewables too quickly could strain the power system, risking blackouts and price spikes. Renewable deployment faces additional hurdles, including typhoon vulnerabilities and infrastructure constraints.

As Oplas notes, a technology-agnostic approach—one that balances firm, affordable baseload power with a measured expansion of renewables—remains the most effective way to ensure reliable, moderate-cost electricity while supporting broader economic stability and controlling inflation.

A pragmatic, balanced approach remains far more effective. By maintaining reliable baseload power while gradually integrating renewables, the Philippines can protect affordability, support economic expansion, and steadily move toward cleaner energy. Only once basic needs are secured and the nation is in a position to act without endangering livelihoods does the ethical and practical case for a net-zero target become compelling.

Sources:

https://www.philstar.com/business/2026/01/02/2498140/philippines-coal-demand-seen-growing-15-2030

https://businessmirror.com.ph/2025/09/08/govt-mulls-over-easing-ban-on-coal-projects

https://businessmirror.com.ph/2025/11/03/doe-stands-pat-on-wider-exceptions-to-coal-freeze

https://oilprice.com/Latest-Energy-News/World-News/China-Accelerates-Coal-Plant