Table of Contents

Global institutions and media have hailed renewable energy (RE) as a silver bullet that could drastically cut electricity costs. In the Philippines, the International Monetary Fund (IMF) has highlighted projections of cheaper power thanks to growing wind and solar capacity and renewable auctions.

According to an IMF study, the Philippines faces some of the highest electricity prices in ASEAN, though recent data show costs falling. Average annual prices dropped to ₱4.14 per kilowatt-hour (kWh) in the first half of 2025 from ₱5.58 in 2024, with further reductions expected through the Green Energy Auction (GEA) Program. Successful auctions could cut Luzon’s average rates by roughly 32% by 2029, with similar gains projected for the Visayas and Mindanao grids.

The IMF further warns that without a sustained shift to RE, the Philippines’ reliance on imported fossil fuels could climb to “61.1 percent by 2050, exposing the economy to global commodity price volatility and posing risks to trade balance and overall macroeconomic stability.”

Yet behind the optimistic projections is a more complicated reality. High electricity prices, the added costs of renewable energy, hidden system expenses, and lessons from other countries rushing their transitions suggest that the Philippines would benefit from a pragmatic, measured approach to its energy shift.

(Also read: WESM Prices Fall in January As Visayas, Mindanao Sees Major Declines)

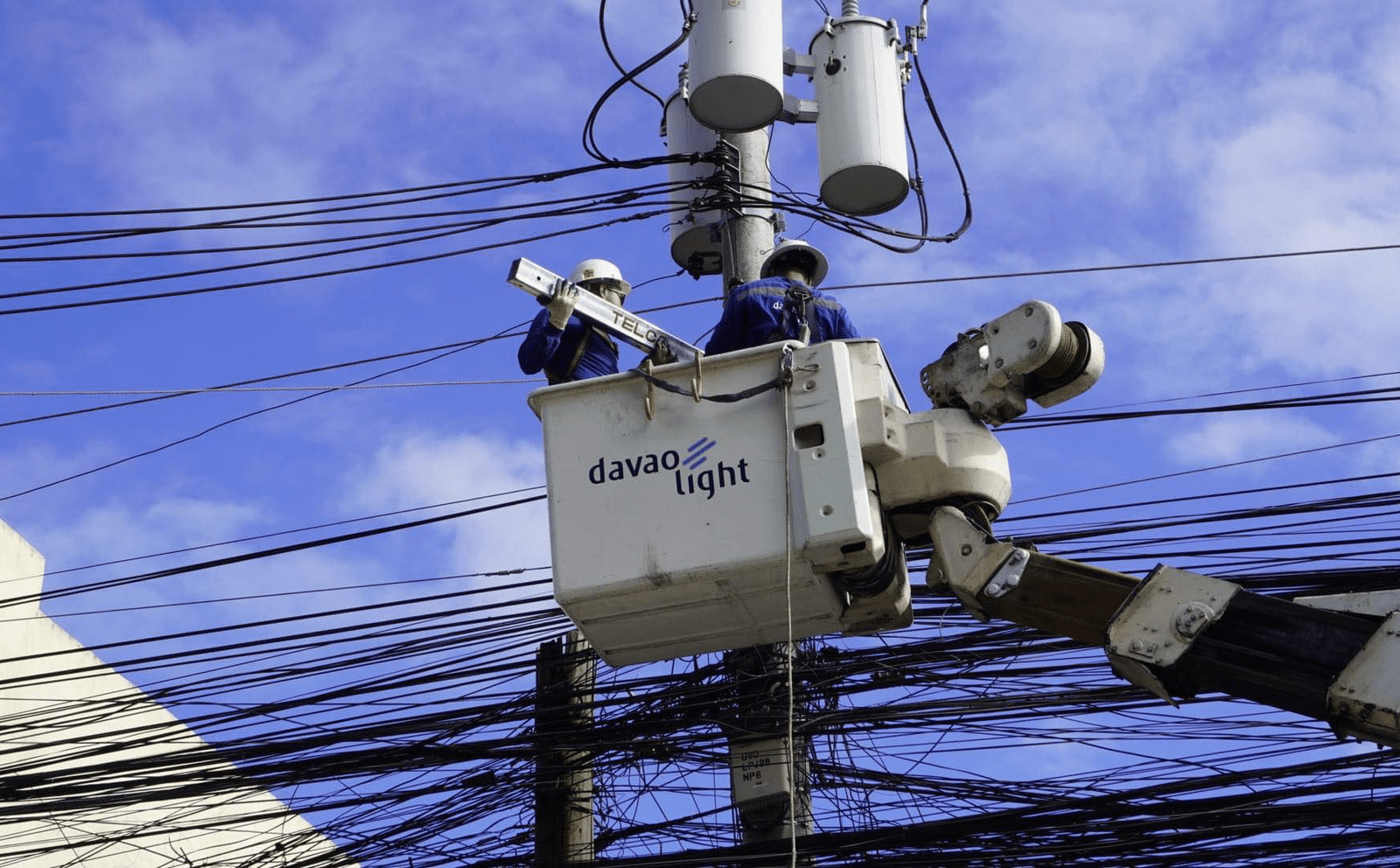

Why Electricity Is So Expensive in the PH

Energy costs and supply reliability shape competitiveness across Southeast Asia, and the Philippines stands out for its high power prices. While global comparisons are debated, analysts consistently place Philippine electricity among the region’s most expensive, at around $0.18 per kWh, compared with about $0.10 in Indonesia, $0.13 in Thailand, $0.08 in Vietnam, and as low as roughly $0.03 in Malaysia.

High electricity prices in the Philippines are mostly due to minimal government subsidies. Unlike many countries that use public funding, tax breaks, or incentives to lower power costs, Philippine electricity providers receive little financial support, leaving consumers to shoulder the full cost of generation, infrastructure, and operations.

“Our neighboring countries like Thailand, Taiwan, Vietnam, Malaysia, Sri Lanka, Indonesia, and South Africa boast lower electricity prices because their governments subsidize 36 to 60 percent of the costs,” Department of Energy (DOE) Undersecretary Rowena Guevara explained.

Electricity prices in the Philippines are further inflated by a 12% value-added tax (VAT) applied across generation, transmission, and distribution. The levy adds directly to consumer bills, compounding already high power costs.

In December, major business groups and a labor organization backed a proposal to exempt electricity from VAT. The Philippine Chamber of Commerce and Industry, Employers Confederation of the Philippines, Philippine Exporters Confederation, and the Trade Union Congress of the Philippines endorsed House Bill 6740, arguing that removing VAT would cut operating costs, support MSMEs, and strengthen employment and GDP growth.

“The organizations emphasized that electricity is a basic and indispensable input affecting households, small and large enterprises, and key industries,” declared the organizations. “Exempting electricity from VAT would provide immediate relief to consumers.”

Renewable Energy Elevating Power Prices

While the IMF points to cheaper power from expanding wind and solar capacity, a new cost has already been added to electricity bills. Beginning January 2026, the Energy Regulatory Commission (ERC) implemented the GEA allowance (GEA-All), a charge collected by utilities, the grid operator, and suppliers to compensate RE developers, with the cost passed directly on to consumers.

The GEA-All mirrors the feed-in tariff allowance, charging all grid users a per-kWh fee. Priced at ₱0.0371 per kWh, it is expected to raise about ₱5.7 billion and will appear as a separate item on electricity bills. The proceeds will be administered by the National Transmission Corporation (TransCo), which will disburse payments to eligible RE developers for their power generation.

The IMF cites renewables for early 2025 price drops, but other factors played a major role. Data from the Independent Electricity Market Operator of the Philippines (IEMOP) show that wider system supply margins and lower overall demand, particularly during cooler months, have helped push prices down by creating excess generation relative to consumption.

IEMOP also acknowledged that natural gas-fired power plants, which can quickly adjust output to balance renewable supply, contributed to lowering spot prices in 2025.

Additionally, IEMOP noted that spot price declines are also supported by energy efficiency measures, with businesses and government agencies shifting high-energy operations to ease peak demand. Expanded transmission projects have further reduced congestion costs and enabled wider access to power.

PhilStar columnist Bienvenido Oplas argues that keeping a strong share of coal-fired baseload generation has helped stabilize electricity prices, especially during tight reserve margins and spot market spikes. In fast-growing regions like Cebu, reliable coal power ensures a steadier supply of competitively priced electricity, preventing sharp increases in household bills and easing cost-of-living pressures. Oplas adds that while RE is crucial for lowering long-term averages, its intermittent nature requires pairing with dependable baseload capacity to avoid price shocks and outages that can raise costs for consumers and businesses.

Myrna Velasco of Manila Bulletin agrees that while the DOE foresees that RE auctions could lower wholesale electricity prices, consumers may not immediately reap the benefits. Because priority dispatch allows renewables to bid “zero” in the spot market, “an illusion of cheaper electricity is created,” she explained. “This artificial dip won’t translate to lower bills if the GEA-All surcharge remains on an uptrend.”

Meanwhile, business journalist Val Villanueva points out that large projects, such as the 3.3-gigawatt fixed-bottom offshore wind (OSW) program, will expand renewable capacity but carry high tariffs around ₱12/kWh. He warns, “OSW will still impose a significant price impact for years. It will be a burden on the grid before it becomes a strategic advantage.”

The Hidden Costs of Rapid Renewable Adoption

Countries that embraced the green energy transition early are now confronting unexpected consequences. The drive toward renewable sources has exposed vulnerabilities in Europe’s power systems, particularly when extreme conditions or sudden shifts in demand collide with intermittent generation.

In April 2025, a massive blackout in Spain and Portugal left tens of millions without power for hours. Roughly 15 gigawatts—about 60% of the Iberian Peninsula’s electricity supply—vanished almost instantly, underscoring the difficulty grid operators face in balancing highly variable renewable output during critical periods.

Meanwhile, the Netherlands’ power grid is struggling to keep pace with its renewable surge, as rising demand and supply outstrip infrastructure, creating bottlenecks that may take years and billions of euros to fix.

Germany, a global leader in renewable adoption, also felt the strain when wind and hydropower output dipped early in 2025. The country had to increase coal use and gas generation, giving fossil fuels their largest share of the energy mix since 2018. This highlighted that, despite ambitious decarbonization, traditional fuels remain essential when intermittent sources underperform.

The UK also shows the high financial cost of a rapid transition. Once one of Europe’s cheapest electricity markets, costs have jumped, with businesses now spending 50% more than peers across the continent. Economist Dieter Helm noted that inefficiencies from the accelerated renewable shift have forced the system to double generation capacity, storage, and imports, with gas still needed to cover occasional shortages. Household energy debt hit an eight-year high in the winter of 2025, rising nearly 30% to £780 million (US$1.04 billion), as levies for grid upgrades, nuclear, and emerging technologies like green hydrogen are passed directly onto consumers.

The experience across Europe underscores a cautionary lesson: transitioning to renewables, while crucial for climate goals, comes with operational, financial, and societal challenges that cannot be ignored.

(Also read: Baseload Power: The Backbone of a Future-Ready Energy System)

Is More Intermittent Renewables the Answer for the PH?

As the Philippines faces rising electricity demand in the coming years, the question is whether adding more intermittent RE will lower costs as the IMF projects. Experience from Europe and other wealthy countries suggests caution. While renewables are important for climate goals, they cannot yet provide the reliable and affordable energy that growth requires. Economic development and meeting basic needs depend on energy that can be counted on day after day.

Countries like the UK show the risks of an aggressive green transition. Shadow Net Zero Secretary Claire Coutinho has accused current net-zero policies of misleading the public and hurting the economy, warning that promises of lower household bills are unrealistic and that policies could make the country poorer. Similarly, Australia has formally abandoned strict net-zero targets. Major parties argued that energy affordability, economic growth, and regional priorities must come before rigid emissions deadlines. These examples show that even wealthy nations with mature infrastructures struggle to balance intermittent RE with reliable supply and economic stability.

For the Philippines, an emerging economy still addressing poverty, disease, and basic infrastructure needs, the stakes are even higher. Costly grid upgrades, battery storage, and other system enhancements needed to accommodate intermittent sources are not trivial. While RE has a role in the country’s energy mix, a cautious and phased approach that prioritizes reliable and affordable power is essential to support long-term development without risking economic or social setbacks.

Sources:

https://www.pna.gov.ph/opinion/pieces/926-impact-of-high-energy-costs-on-theeconomy

https://cebudailynews.inquirer.net/583377/electricity-in-ph-why-is-it-high

https://mb.com.ph/2025/05/22/electric-co-op-group-calls-for-vat-removal-to-ease-consumer-burden

https://mb.com.ph/2025/12/12/erc-sets-new-power-fee-at-00371kwh-to-fund-renewable-projects

https://mb.com.ph/2025/12/22/bbm-admins-emerging-legacy-normalizing-high-power-rates

https://www.bbc.com/news/articles/cn40y9yxkgvo

https://theweek.com/tech/why-britains-electricity-bills-are-some-of-the-highest-in-the-world

https://news.stv.tv/politics/energy-debt-hits-eight-year-high-ahead-of-winter

https://www.abc.net.au/news/2025-11-02/nationals-formally-abandon-net-zero-by-2050/105962162

https://www.gbnews.com/politics/ed-miliband-accused-leading-britons-down-garden-path-net-zero-policy