Table of Contents

The Philippines has struggled for years with some of Southeast Asia’s highest electricity costs and ongoing reliability challenges, and the consequences ripple through the economy — affecting households, producers, and investors alike.

Meanwhile, neighboring ASEAN countries, such as Vietnam, Thailand, Indonesia, and Malaysia, have adopted more pragmatic energy policy approaches that balance fossil fuels with diversification, lowering costs while maintaining a stable energy supply and industry operations.

If the Philippines is serious about sustainable growth and competitiveness, it needs to learn from these regional strategies, rather than idealizing a rapid, intermittency‑heavy shift to renewables alone.

(Also read: VinFast Powers Davao’s Electric Future)

PH faces high electricity costs

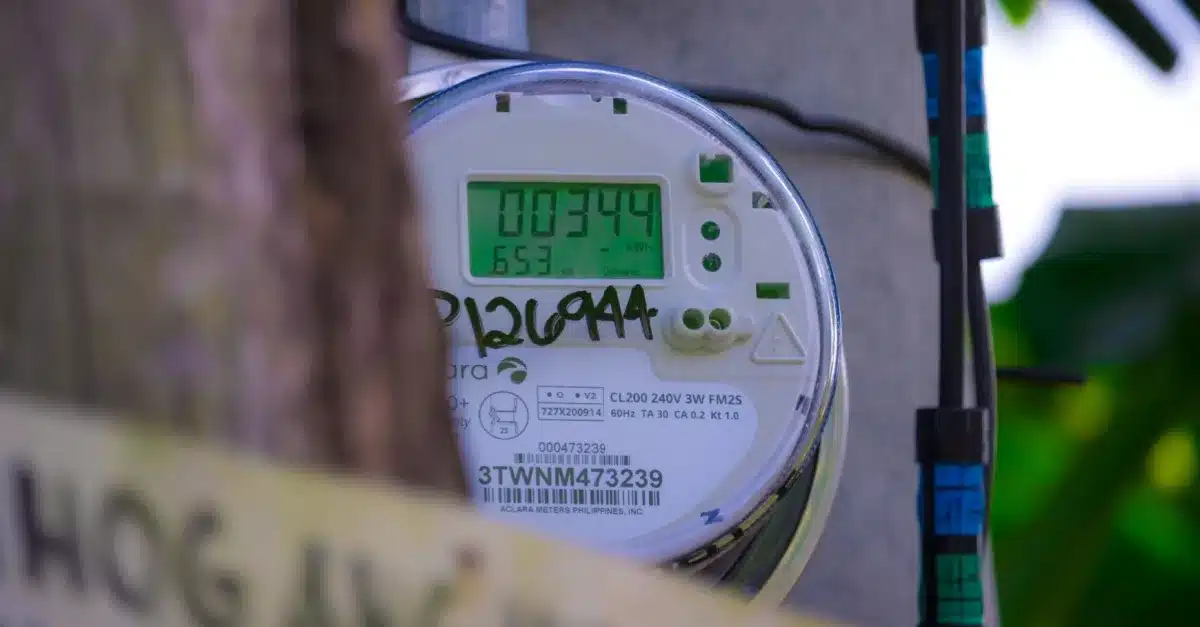

Across Southeast Asia, energy costs and supply reliability heavily influence economic competitiveness. Even though there is debate over how rates compare globally, it’s widely acknowledged that Filipino consumers pay among the highest electricity prices in the region. According to analysts, Philippine electricity can reach around US$0.18 per kilowatt‑hour (kWh), compared with $0.08 in Vietnam, $0.10 in Indonesia, $0.13 in Thailand, and as low as 40.03 in Malaysia.

According to government consultant Brian James Lu, the Philippines’ persistently high electricity costs are more than a nuisance; they impose deep economic and social consequences that undermine growth, competitiveness, and everyday life.

These elevated energy prices squeeze households and businesses alike. For Filipino families, costly electricity eats into limited budgets, forcing difficult trade‑offs between power and essentials like food, education, and healthcare.

For businesses, energy is not optional but a fundamental cost of production. When electricity prices remain high, operational expenses rise, profit margins shrink, and competitiveness erodes. Large manufacturers with heavy energy needs may survive these pressures, but micro, small, and medium‑sized enterprises (MSMEs), which employ a significant share of the workforce, are far more vulnerable. With limited capacity to absorb or pass on higher costs, many MSMEs struggle to stay afloat, threatening closures and job losses with broader effects on the national economy.

High energy costs also deter foreign investment, a crucial engine of growth. Global companies seeking new markets look for locations with stable supply, competitive input costs, and strong returns.

“These high energy costs have far-reaching consequences,” wrote Lu. “They hinder economic competitiveness, raise the cost of goods, and lower the standard of living for many Filipinos.”

Several factors contribute to the Philippines’ higher electricity costs, including the following:

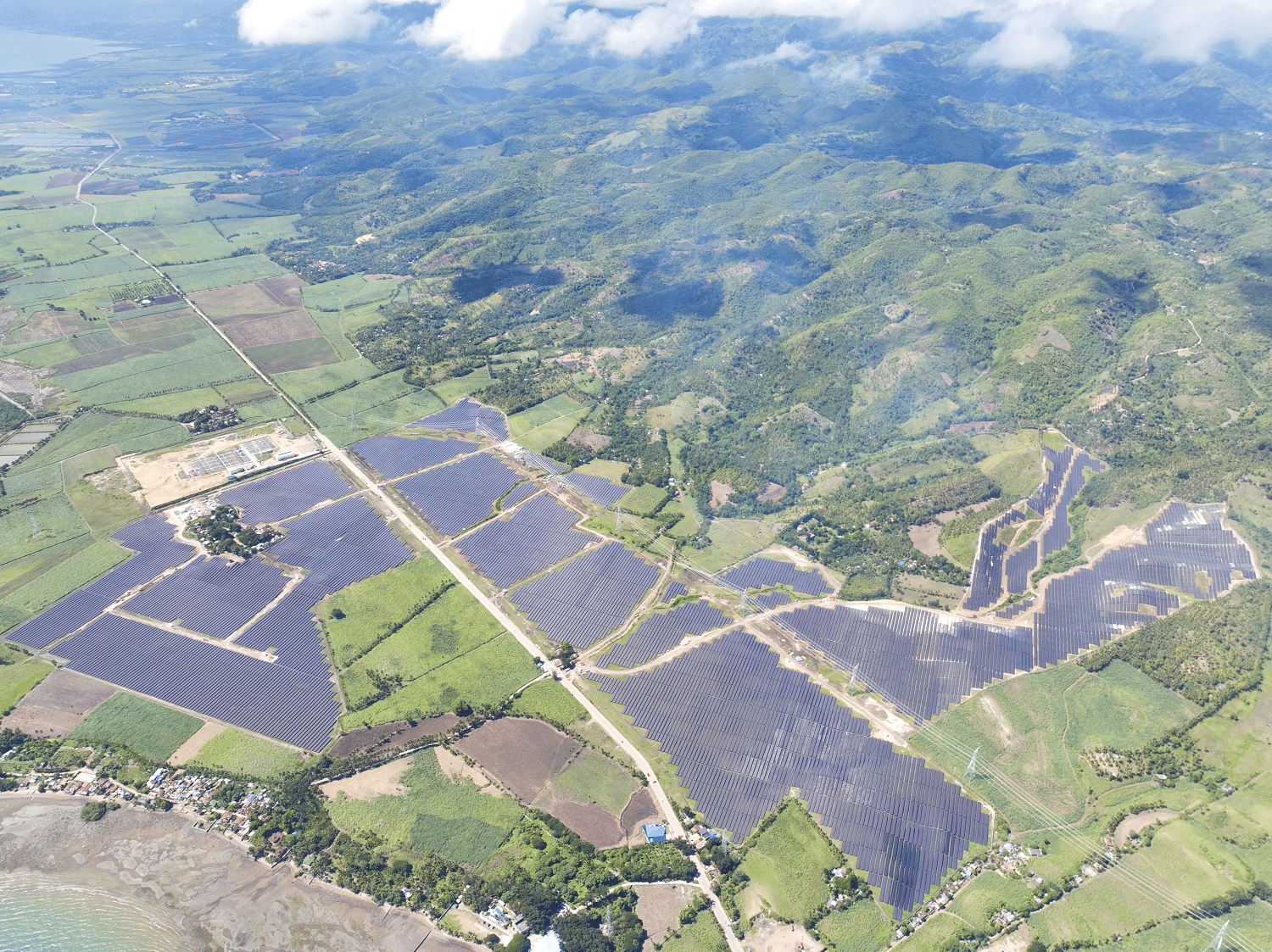

- Transitioning to renewable energy

The cost of transitioning to renewable energy (RE) is itself driving up electricity prices in the short term. To promote renewables, the government has long used a feed-in tariff (FIT) system that guarantees fixed payments to RE producers. In late 2025, the Energy Regulatory Commission (ERC) approved a higher feed-in tariff allowance (FIT-All) rate to ensure timely payments to RE producers, a charge that is passed on to consumers’ bills.

Now, beginning January 2026, a new charge called the Green Energy Auction Allowance (GEA-All) will also appear on electricity bills at ₱0.0371 per kWh. This separate line item is intended to compensate RE developers under the Green Energy Auction program, further adding to consumers’ costs even as the government seeks to expand RE capacity.

Critics argue these RE-related levies contribute to already high tariffs and risk exacerbating economic burdens, even as longer-term projections suggest renewables could eventually help reduce wholesale prices.

- Limited government support

High electricity prices in the Philippines are also driven by the limited role of government subsidies. In many countries, governments help lower electricity costs through direct funding, tax breaks, or incentives that reduce production and delivery expenses.

In the Philippines, however, electricity providers receive little to no financial support. This means the full cost of generation, infrastructure, and operations is passed directly to consumers.

“Our neighboring countries like Thailand, Taiwan, Vietnam, Malaysia, Sri Lanka, Indonesia, and South Africa boast lower electricity prices because their governments subsidize 36 to 60% of the costs,” Department of Energy (DOE) Undersecretary Rowena Guevara stated.

- Insufficient power generation

A working paper from the Ateneo Center for Economic and Development also identifies inadequate generation capacity as one of the key factors behind the Philippines’ high electricity costs, alongside governance issues and limited competition in the power sector.

The Philippines’ electricity system continues to struggle with limited generation capacity relative to growing demand, contributing to higher energy prices. A lack of sufficient and dependable capacity means the country must operate with very thin reserve margins.

While new capacity additions are planned, much of this growth is from variable renewable energy (VRE) sources, which do not provide the same reliable baseload power as conventional fossil fuel plants. As PhilStar’s Boo Chanco wrote, “Doesn’t sound too solid because a megawatt of VRE is worth much less than a megawatt of conventional baseload coal or natgas (natural gas) for grid stability.”

(Also read: Davao Light Brings Reliable, Affordable Power to Davao del Norte)

- Delayed and additional transmission infrastructure

The DOE is drafting a policy that would allow power producers to finance and build key transmission facilities to accelerate the delivery of new power projects. The proposal follows years of grid congestion that have stranded many generation plants despite having their own point-to-point connections.

Transmission delays are a major deterrent to investment, with grid projects typically lagging new power plants by three to five years. This also keeps usable supply tight and weakens competition, forcing the system to rely on a smaller set of plants and driving up wholesale electricity prices.

Under the draft circular, generators would be permitted to build “associated transmission projects” such as substations and shared lines, helping bridge the widening gap between growing generation capacity and an underdeveloped grid.

The DOE reports that many transmission projects face delays of one to nine years, with full completion often taking eight to ten years, due to permitting, right‑of‑way, and construction hurdles. This mismatch leaves new generation capacity stranded, forcing utilities to operate costly backup systems or run existing plants inefficiently.

Additionally, the Philippines’ RE drive carries a hidden cost that rarely appears in policy slogans: because solar and wind are variable and dependent on the weather, the grid must keep full backup systems—either batteries or fast-ramping conventional plants—on standby at all times, effectively forcing the country to build and maintain two power systems to do the work of one, a duplication that inflates capital spending, adds layers of grid services and reserve capacity, and ultimately shows up in higher electricity bills for consumers.

How neighboring countries manage energy affordability and reliability

As the Philippines grapples with rising power costs and fragile grid reliability, the experience of neighboring ASEAN countries offers timely lessons on how energy systems can be made both affordable and dependable.

- Vietnam: Balanced growth with coal, gas, renewables

Vietnam’s energy sector is a useful case study in balancing economic growth with energy infrastructure development. While it is expanding renewable capacity and mapping long‑term cleaner pathways, it has continued to rely on coal and gas to provide dependable baseload power to industry and households.

Vietnam’s electricity remains heavily reliant on fossil fuels, with coal accounting for 48.5% and natural gas 6.9% of total consumption, while the country pushes renewables into the mix. Clean energy now contributes roughly 44% of generation, led by hydropower, with solar at over 8% and wind just above 4%.

In April 2025, Vietnam’s government updated its Power Development Plan 8 (PDP8), which reintroduces nuclear power—4,000 to 6,400 MW by 2035 and more by 2050—and boosts renewable and storage capacity.

Liquefied Natural Gas (LNG) is set to play a key transitional role in Vietnam’s energy mix, with LNG projects replacing aging coal plants while providing flexible, lower‑emission power. The country plans to install roughly 37 GW of LNG capacity by 2030, bridging the gap toward a cleaner, more sustainable energy system.

Takeaway for the PH: Vietnam’s pragmatic energy policy has underpinned its rapid economic rise, in stark contrast to the Philippines, where high electricity prices, long transmission delays, and a policy focus on fast‑tracking even costly renewable projects have pushed power costs higher for consumers.

According to the International Energy Agency (IEA), electricity demand in Vietnam grew eightfold from 2002 to over 240 terawatt-hours (TWh) in 2022, driven primarily by industry, particularly manufacturing, while residential and commercial use also expanded rapidly. The country scaled natural gas in the 2000s, followed by coal and hydro from 2010 to 2020, and a recent surge in solar PV, creating a diversified, reliable, and affordable power supply.

This steady, flexible approach has enabled Vietnam to power industrialization with fewer disruptions, attracting investment and boosting GDP per capita to around $4,650 in 2024, ahead of the Philippines’ $4,150, and maintaining higher manufacturing appeal.

- Indonesia: Strong fossil base with emerging diversification

Indonesia remains heavily dependent on fossil fuels for electricity, with coal accounting for around 62% of generation. As the world’s top coal exporter, it keeps electricity from coal-fired power plants affordable through its Domestic Market Obligation (DMO) policy, which caps coal prices for domestic use at around $70 per ton. By stabilizing fuel costs, the policy ensures relatively low and predictable generation expenses.

The IEA points out that Indonesia’s power sector remains heavily anchored in fossil fuels, with a young fleet of coal-fired plants supplying over 60 % of electricity and expected to meet a large portion of demand for years ahead. Natural gas contributes nearly 20 % of generation, providing flexible, dispatchable capacity that complements coal and supports grid stability amid rising consumption.

Thanks to a stable power supply, Indonesia is experiencing rapid economic growth and is projected to become the world’s fourth-largest economy by 2050.

Takeaway for the PH: The Philippines’ struggle with reliable power contrasts sharply with Indonesia’s more stable supply. Studies show Filipino consumers faced an average of 5.7 power interruptions and nearly 9 hours without electricity. A five‑hour blackout can cost the economy around ₱556 million in lost output.

Outages also hurt local communities and governments, with frequent interruptions reducing business and property tax collections and compromising essential services. To avoid similar economic drains and support rapid industrialization, the Philippines’ development imperative is clear: prioritize energy security and cost reduction. A balanced energy strategy that pairs competitive renewables with dependable baseload power, strengthened grid infrastructure, and storage solutions would protect consumers, reduce disruptions, and create a more competitive environment for business and investment.

- Malaysia: Broad government subsidies

The Malaysian government maintained electricity tariffs in Peninsular Malaysia from January 1 to June 30, 2025, with no increases in base tariff, rebates, or surcharges during this period. This was done by providing direct support and subsidies to absorb cost changes. The total electricity subsidy provided by the government for the first half of 2025 was approximately RM5.96 billion ($1.46 billion), ensuring stability for consumers.

To soften the impact of higher fuel costs, the government continued to provide targeted electricity subsidies for domestic users with monthly consumption between 600 kWh and 1,500 kWh. This support protected about 85% of households, or roughly 7.1 million consumers, from any increase in their electricity bills.

Takeaway for the PH: The Philippines imposes a 12% value-added tax (VAT) on electricity, applying it across generation, transmission, and distribution. This layered taxation inflates power bills for households and businesses, adding to already high energy costs faced by consumers.

Recently, leading business groups and a labor federation backed a proposal to scrap VAT on power sales, arguing it would ease operating costs and strengthen competitiveness. They endorsed House Bill 6740, filed by Deputy Speaker Raymond Mendoza, saying cheaper electricity would support MSMEs, attract energy-intensive investments such as data centers and advanced manufacturing, and help protect and create jobs.

Though this would not constitute a subsidy in the way Malaysia underwrites electricity prices, scrapping VAT on power would still deliver immediate relief to consumers and business owners by cutting a major cost component from monthly bills, improving cash flow for firms, and easing household spending pressures at a time of persistently high energy prices.

Conclusion: A pragmatic path forward

Southeast Asia’s energy landscape reveals a clear pattern: countries that balance affordable fossil fuels, gradual renewable integration, strategic infrastructure investment, and sound regulatory frameworks are gaining competitive advantages. Vietnam, Indonesia, Malaysia, and Thailand demonstrate that maintaining dependable power supplies — backed by practical fuel mixes — supports industrial growth, attracts investment, and keeps consumer costs manageable.

Additionally, cutting fossil fuel use on its own will not shield the Philippines from climate change. The country accounts for only 0.5% of global greenhouse gas emissions, meaning even drastic domestic reductions would barely register against the forces driving global warming.

For the Philippines to match or surpass its neighbors, it must adopt similarly pragmatic, growth‑oriented energy policies. Prioritizing baseload reliability, diversifying fuels intelligently, modernizing the grid, and protecting consumers through targeted programs will help unlock pathways to long‑term prosperity.

The Philippines must put development, human prosperity, and economic competitiveness at the forefront of its energy strategy. A frenzied rush to adopt RE, driven more by international virtue signaling than practical benefits, risks inflating electricity costs without delivering real value to Filipino households or businesses.

Policies that prioritize optics over outcomes do little to strengthen the economy, and may instead undermine the very growth and stability that affordable, reliable power is meant to support.

Sources:

https://www.pna.gov.ph/opinion/pieces/926-impact-of-high-energy-costs-on-theeconomy

https://cebudailynews.inquirer.net/583377/electricity-in-ph-why-is-it-high

https://www.philstar.com/business/2025/01/17/2414710/weak-link-power-sector

https://opinion.inquirer.net/178064/ensuring-energy-security-and-affordability

https://lowcarbonpower.org/region/Vietnam

https://www.iea.org/reports/achieving-a-net-zero-electricity-sector-in-viet-nam/executive-summary

https://jakartaglobe.id/business/indonesia-worlds-top-coal-and-nickel-exporter-to-cut-output

https://www.iea.org/reports/enhancing-indonesias-power-system/executive-summary

https://www.pids.gov.ph/details/news/in-the-news/power-outages-result-in-millions-of-economic-losses

https://www.pids.gov.ph/details/news/in-the-news/consumer-hours-lost-to-power-interruptions-rose-10

https://www.pna.gov.ph/index.php/articles/1261419

https://mb.com.ph/2025/12/12/erc-sets-new-power-fee-at-00371kwh-to-fund-renewable-projects

https://mb.com.ph/2025/12/22/bbm-admins-emerging-legacy-normalizing-high-power-rates

https://www.philstar.com/business/2023/07/26/2283734/doe-ensure-time-completion-grid-connections