Table of Contents

Baseload power is the minimum amount of continuous electricity supply that an electrical grid must deliver at all times to keep homes, industries, hospitals, and critical infrastructure running smoothly. Simply put, it is the foundation of any stable energy system — the flat line of electricity demand that never goes away, even in the dead of night or during slack consumption periods. Baseload power is produced by plants that deliver a reliable, uninterrupted electricity flow to ensure that the grid’s most fundamental needs are met 24/7.

Meeting this baseline demand is critical for grid stability and energy security because fluctuating or intermittent sources alone, such as wind and solar, cannot guarantee an uninterrupted supply without complementary systems like storage or dispatchable backup. Without dependable baseload capacity, blackouts and costly power disruptions become real risks.

Types of Baseload Power: What Powers the Grid Around the Clock

Historically, baseload electricity has come from sources that can deliver constant and controllable output, which means they can run continuously at a relatively stable level without frequent fluctuations.

Coal

Coal plants are the most classic example of baseload generators because they provide steady, dispatchable electricity, capable of running day and night without interruption. These plants do not change output quickly, making them well-suited for meeting the minimum continuous demand.

For decades, coal has underpinned baseload electricity generation worldwide, thanks to its wide availability and well-established methods of production. According to Rappler’s Den Somera, fossil fuels historically powered social and economic progress, providing the energy needed for societies to grow and for people to thrive.

“As of now, coal remains to be an important energy source in Southeast Asia,” he wrote. “It provides sufficient energy at the lowest cost possible and serves as a reliable baseload generation source that can provide a stable and continuous supply of electricity.” He added that coal-fired plants continue to supply the bulk of energy for key industries, including iron, steel, and cement production globally.

In the Philippines, coal has long dominated as a baseload source, supplying around 62% of power generation, even as renewables grow.

Nuclear Power

Nuclear plants are designed to run at high capacity factors, often above 92 %, producing steady, predictable output and ensuring grid stability regardless of weather or daylight conditions. This makes them particularly suitable to meet constant demand and support economic activity.

Several countries depend heavily on nuclear power for their baseload needs. France, for example, generates about 70 % of its electricity from nuclear energy, making it a central pillar of the nation’s power system. The US, China, and Finland also operate significant nuclear fleets, with the US producing 18% of its electricity from nuclear sources and Finland’s reactors providing around 41 %.

According to the International Atomic Energy Agency (IAEA), nuclear power plants produce almost no greenhouse gas emissions while generating electricity. Meanwhile, the International Energy Agency (IEA) reports that nuclear power has cut carbon dioxide emissions by over 60 gigatonnes in the past 50 years, which is equivalent to nearly two years of global energy-related emissions.

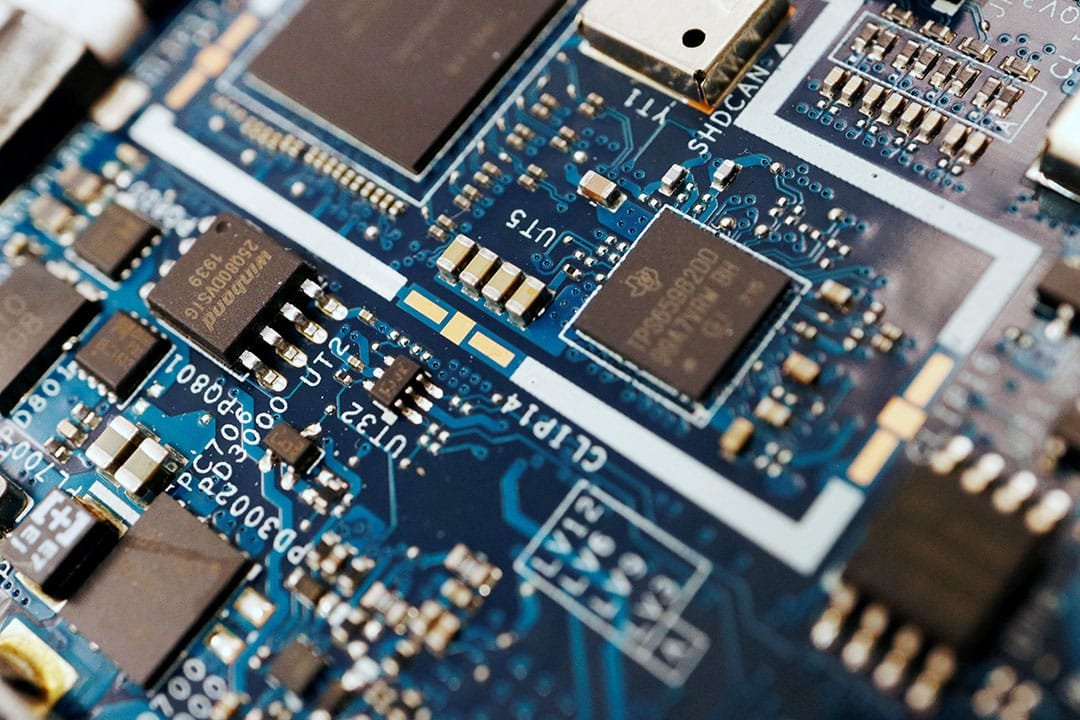

In the Philippines, authorities are actively mapping out a path to incorporate nuclear power into the energy mix. Policy frameworks designate the planned “Pioneer” nuclear plant as a baseload facility with priority grid access. The government plans to launch 1,200 megawatts (MW) of nuclear power by 2032, doubling capacity to 2,400 MW by 2035 and targeting a long-term goal of 4,800 MW by mid-century.

Natural Gas

Many countries rely on natural gas as a baseload and “bridge” fuel in the transition to cleaner energy because it emits significantly less CO₂ than coal and can provide reliable power when renewables aren’t available. For example, Japan is one of the largest importers of liquefied natural gas (LNG) worldwide and uses it extensively to meet energy demand after the earthquake and tsunami caused meltdowns at the Fukushima nuclear power plant, causing the shutdown of most nuclear facilities in the country.

Singapore also operates major LNG‑fired plants to ensure firm power alongside renewables. According to the Singaporean government, natural gas provides 95 % of Singapore’s electricity and will remain a key energy source as low‑carbon alternatives expand.

The advantages of natural gas include lower carbon emissions compared with coal, fast ramp‑up times, and flexibility to provide baseload or backup power. Gas plants can start quickly and adjust output as demand shifts, making them effective in mixed grids.

In the Philippines, natural gas already accounts for a growing portion of power generation (about 22 % of the mix), supported by LNG imports and local production. The country’s only indigenous source, the Malampaya gas field, has been extended and, in early 2026, a new gas discovery called Malampaya East‑1 was announced, projected to hold roughly 98 billion cubic feet of gas, enough to generate about 14 billion kilowatt‑hours (kWh) of electricity each year.

Policies like the Philippine Natural Gas Industry Development Act aim to expand gas infrastructure and integrate natural gas more deeply into the energy mix.

Geothermal energy

Geothermal energy is a reliable source of baseload electricity because it produces steady power continuously, well‑suited to provide the minimum continuous power needed to sustain an electricity grid.

Globally, installed geothermal capacity is significant though modest compared to other sources, at about 16.9 gigawatts (GW). The top producers are the US, Indonesia, and the Philippines, whose abundant geothermal energy comes from being part of the volcanically active Pacific Ring of Fire, where underground heat from magma and tectonic activity creates ideal conditions for geothermal resources.

Advantages of geothermal include high reliability and capacity factors of often over 90 %, low operating costs once built, and minimal emissions compared with fossil fuels.

In the Philippines, geothermal has long been a cornerstone of renewable power. Plants in Leyte, Tiwi, and other fields have produced baseload electricity for decades, and geothermal accounted for a substantial share of renewable generation.

However, the sector faces high upfront costs, exploration risk, and permitting challenges, which have slowed rapid expansion despite abundant volcanic resources. The country remains well‑positioned to expand capacity with government support and technology improvements.

Diversified Energy Mix: Ensuring Reliability and Affordability in the PH

The Philippines is at a major crossroads in its energy transition. As global and domestic pressures mount to shift away from fossil fuels toward renewable energy (RE), policymakers, energy experts, and industry stakeholders emphasize the need for a balanced, diversified energy mix — one that retains reliable baseload and transition fuels while steadily integrating renewable technologies. Such a strategy helps ensure energy reliability, affordability, and long‑term sustainability, especially in a rapidly growing economy with rising electricity demand.

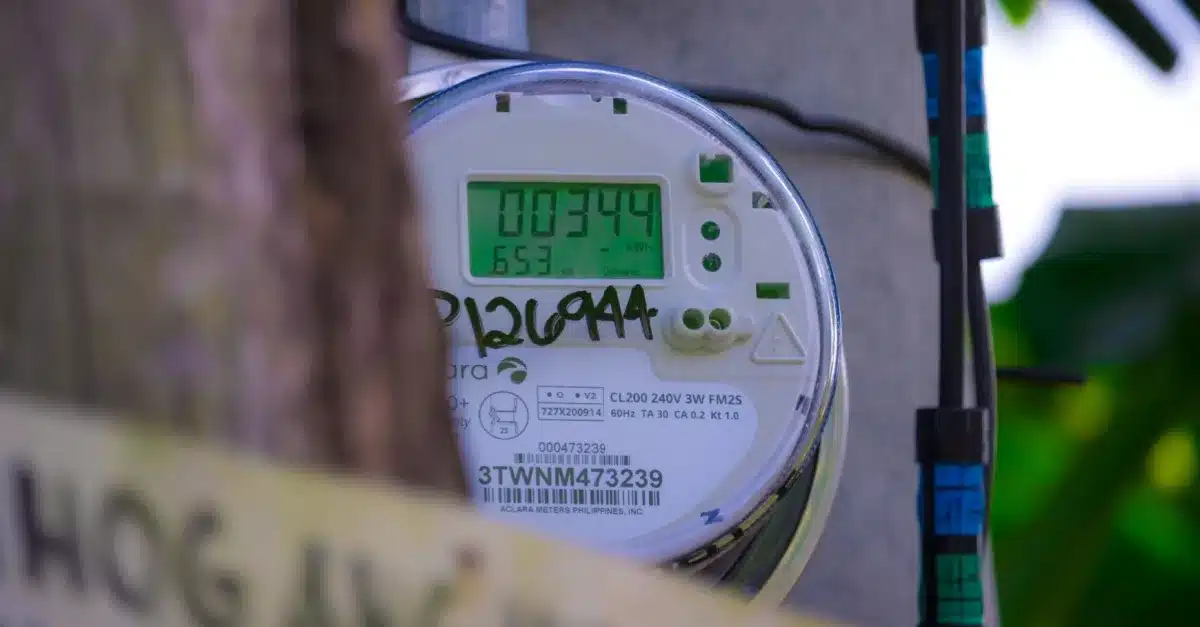

The power sector in the Philippines remains heavily dependent on conventional fossil fuels. Coal dominates the generation mix. Natural gas follows at roughly 14%, while renewables supply about 25.4% of total generation, driven mainly by hydropower and geothermal, with solar and wind still making up a small share.

Ramping up renewables

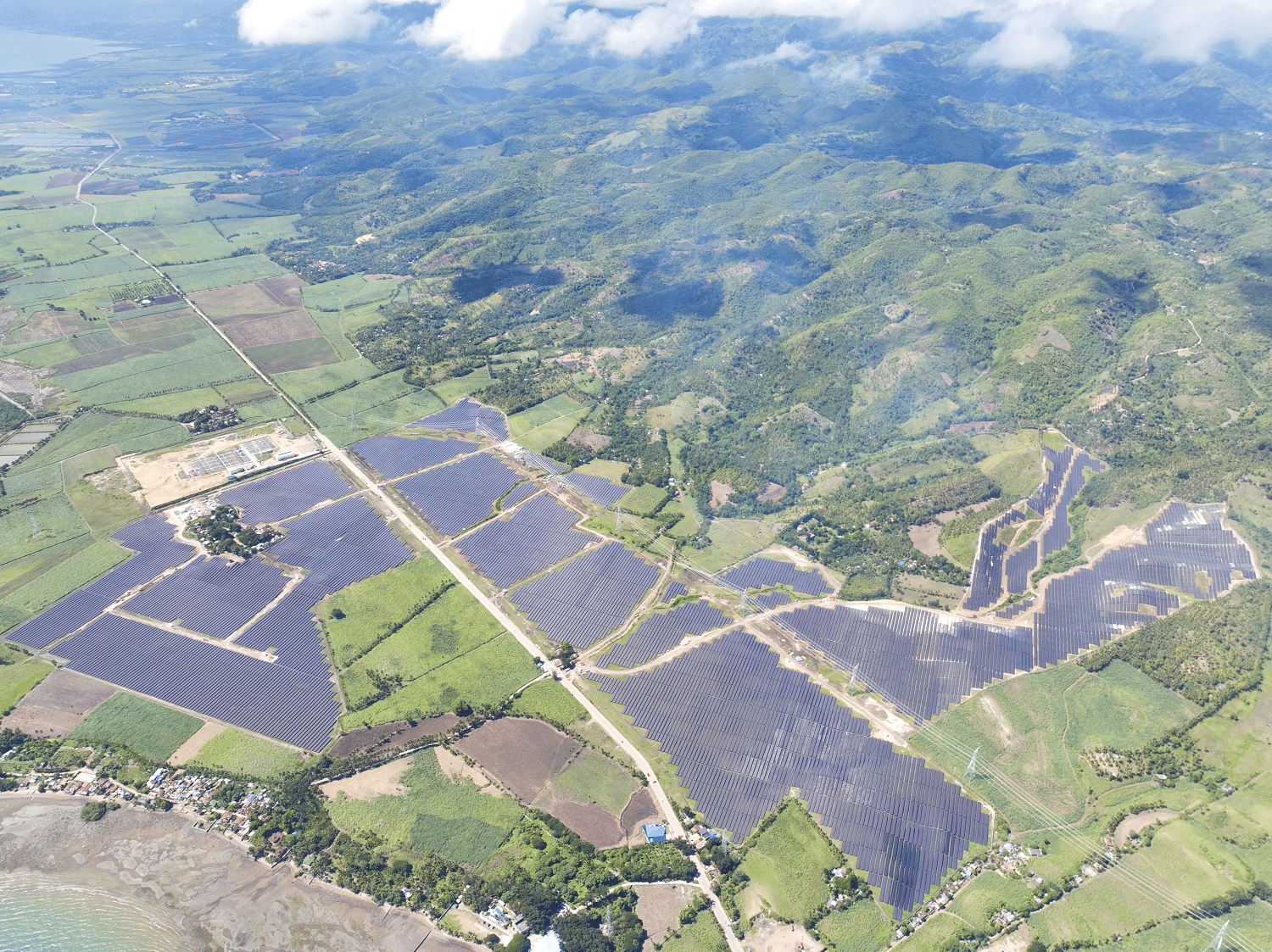

According to the DOE, there is significant progress in renewable capacity additions. In 2024 alone, the country added 794.34 MW of new renewable capacity, more than the total added in the three preceding years combined, highlighting a surge in project development and grid integration.

The DOE has also set strong targets under the National Renewable Energy Program and Renewable Portfolio Standards. The agency aims for renewables to supply 35% of the power mix by 2030 and up to 50% by 2040. Currently, renewables supply about 25.4% of the country’s total generation.

To reach its renewable energy targets, the DOE projects the Philippines will need a total of 52.83 GW of renewable capacity by 2040. Solar is expected to account for the largest share at 27.16 GW, followed by wind with 16.65 GW, hydropower at 6.15 GW, geothermal at 2.5 GW, and biomass contributing around 364 MW.

However, renewable energy in the Philippines faces significant practical and economic challenges despite ambitious targets. Robert Idel, an economist with a Ph.D. from Rice University, applied his Levelized Full System Costs of Electricity (LFSCOE) methodology to the country in 2024, providing a more accurate view of the true cost of wind and solar. Unlike traditional measures, LFSCOE accounts for the extra expenses needed to make intermittent sources reliable, such as energy storage and backup power.

Solar energy faces its own hurdles. Land availability in the Philippines is constrained, and large solar farms compete with agricultural use. Also, storage remains a key factor, and Idel’s analysis suggests that renewable technologies could become much more competitive only if battery prices fall by up to 80%.

Adding to the challenge of renewable energy affordability is the rollout of GEA 5, which targets offshore wind capacity. According to the Energy Regulatory Commission, offshore wind electricity comes at roughly ₱14 per kWh, nearly three times higher than some recent solar power purchase agreements, which have been signed at around ₱4.50 per kWh. Such high costs could push electricity bills higher for Filipino households.

Additionally, renewable energy will mean higher electricity costs for Filipinos. Beginning this January 2026, the Energy Regulatory Commission will implement the Green Energy Auction allowance (GEA-All), a ₱0.0371 per kWh charge applied to all grid users to compensate renewable energy developers.

Why coal continues to play a leading role

From a cost perspective, coal continues to play a significant role in the power mix. Coal-fired plants are commonly viewed as among the most affordable baseload options.

Columnist Bienvenido Oplas said coal continues to play a stabilizing role in the country’s power system, particularly during periods when supply tightens, and electricity prices surge in the spot market. He noted that maintaining a sizable share of coal-fired baseload generation has helped cushion consumers from sharp price swings, especially when reserve margins are thin.

In fast-growing areas such as Cebu, Oplas pointed to coal-fired plants as a key source of steady and price-competitive power. This consistent supply, he said, has helped moderate fluctuations in household electricity bills and ease broader cost-of-living pressures linked to power prices.

Oplas stressed that while renewable energy is essential to lowering long-term generation costs and emissions, its variable nature requires support from dependable baseload sources. Without sufficient firm capacity, he warned, greater reliance on intermittent renewables could expose the grid to supply disruptions and sudden price spikes, with knock-on effects for households and businesses.

“The energy transition we should be working toward is one that moves away from unstable, blackout-prone, and costly power,” he stated. “What the economy needs is abundant, stable, and affordable energy to support lower inflation and sustained growth.”

Some non-governmental organizations have raised concerns about the impacts of fossil fuels like coal, oil, and gas on the environment and communities. They often call for a faster shift to cleaner energy, saying it could reduce pollution and health risks, though this is part of a larger debate on balancing energy and environmental needs.

However, The DOE has acknowledged that coal remains a salient part of the Philippines’ energy mix, even as the country pushes to expand renewable power. This view underpins the government’s approach to the 2020 coal moratorium. The DOE has said any phaseout must be “very well calibrated” to avoid supply disruptions, prompting the agency to widen exemptions to the policy.

In October 2025, the DOE approved new exemptions allowing coal projects for self-generation in industrial zones, off-grid areas, and mining operations producing critical minerals, as well as limited on-grid facilities to address imminent power shortages.

“Just because we are pushing for renewable energy (RE), doesn’t mean that we want to abandon baseload. Baseload can be coal, it can be gas, it can be hydro, geothermal,” said DOE Secretary Sharon Garin. “That is the steady, not intermittent. So, we want to push for that. RE is a good source of energy, but it will not be enough.”

Liquefied natural gas (LNG) as a bridge fuel

In the Philippines, natural gas — particularly in the form of liquefied natural gas (LNG) — is widely regarded as the country’s bridge fuel in its transition from high‑emission fossil fuels to cleaner energy. The DOE has signaled that LNG will serve as a cleaner transitional source to help reduce reliance on coal while renewable energy capacity grows, noting that developing renewable infrastructure and indigenous gas resources will take time and make a reliable interim fuel necessary.

Industry and policy analysts echo this position. Natural gas plants are seen as a way to provide stable and flexible power that can back up intermittent solar and wind generation as the grid evolves, smoothing supply and supporting energy security. Leaders in the sector, including firms operating the Malampaya gas field, describe gas‑fired power as a bridge that facilitates the shift away from coal.

Legislative and regulatory developments also reflect this role. Provisions in the Philippine Natural Gas Industry Development Act explicitly promote natural gas as a transition or bridge fuel to reduce dependence on imported coal and oil and to support the scaling up of renewable generation without sacrificing grid reliability or economic performance.

The case for nuclear power

The Philippines’ first and only nuclear facility was the Bataan Nuclear Power Plant (BNPP), constructed in the late 1970s and completed in 1984, but never commissioned due to safety concerns, political controversy, and the Chernobyl disaster. The 621‑MW project was intended to address energy shortages but remained dormant even as the country continued to pay for it for years.

Interest in nuclear power has resurged amid rising electricity demand, concerns over energy security, and the need for low‑carbon baseload generation. The government has taken concrete steps: in September 2025, President Ferdinand Marcos Jr. signed the Philippine National Nuclear Energy Safety Act (Republic Act No. 12305) into law, creating the Philippine Atomic Energy Regulatory Authority (PhilATOM) as an independent regulator to oversee nuclear safety and licensing. This fulfills a prerequisite for pursuing nuclear projects and aligns the Philippines with international standards.

Plans are also underway to explore BNPP’s future. In late 2024, the Philippines and South Korea agreed to conduct a feasibility study on the potential revival of the mothballed plant, examining technical and economic viability.

Public opinion appears favorable: a 2024 Social Weather Stations survey found that over 70 % of Filipinos support nuclear energy as part of the future power mix, citing reliability, reduced fuel import dependency, and climate benefits.

However, opposition remains. Local officials in Bataan have reiterated that reviving the plant is not advisable, questioning its relevance and safety in the modern context. Critics also point to high costs, safety risks, and concerns over siting near fault lines.

Securing the Philippines’ Power Future

The Philippines stands at a pivotal moment in its energy transition. As the country seeks to shift away from coal and other high-emission fuels, experts emphasize that relying solely on intermittent renewable sources is insufficient to ensure a stable and affordable electricity supply. Baseload power remains critical, and a diverse mix of energy sources is essential to meet this baseline demand.

A balanced energy mix allows the country to combine the reliability of coal, natural gas, geothermal, and eventually nuclear power with the environmental benefits of solar, wind, and other renewables. Diversification also enhances energy security by reducing dependence on any single fuel source.

By combining these sources strategically, the Philippines can mitigate price volatility, prevent blackouts, and maintain affordability, ensuring that economic growth is not undermined by energy shortages or high costs.

In short, a diverse energy portfolio is not optional — it is necessary. By pairing intermittent renewables with dependable baseload and transition fuels, the Philippines can achieve a resilient, cost-effective, and sustainable energy future.

Sources:

https://en.wikipedia.org/wiki/Base_load

https://energy.sustainability-directory.com/term/baseload-energy

https://www.energy.gov/ne/articles/nuclear-power-most-reliable-energy-source-and-its-not-even-close

https://world-nuclear.org/information-library/country-profiles/countries-a-f/france

https://www.trade.gov/country-commercial-guides/finland-energy

https://en.wikipedia.org/wiki/Energy_in_the_United_States

https://www.iaea.org/bulletin/what-is-the-clean-energy-transition-and-how-does-nuclear-power-fit-in

https://en.wikipedia.org/wiki/Energy_in_Japan

https://www.mti.gov.sg/energy-and-carbon/energy-supply/natural-gas

https://www.trade.gov/market-intelligence/philippines-liquefied-natural-gas-market

https://www.philstar.com/headlines/2026/01/21/2502388/doe-sees-more-malampaya-gas-discoveries

https://www.acenrenewables.com/2025/11/benefits-geothermal-energy

https://twogreenleaves.org/green-living/philippines-geothermal-energy-rich

https://newsinfo.inquirer.net/2009953/tapping-earths-power-phs-reliable-clean-energy-source

https://businessmirror.com.ph/2025/11/03/doe-stands-pat-on-wider-exceptions-to-coal-freeze

https://businessmirror.com.ph/2025/09/08/govt-mulls-over-easing-ban-on-coal-projects

https://pia.gov.ph/press-release/ph-push-for-renewable-energy-yields-record-breaking-installations

https://www.pna.gov.ph/articles/1222195

https://drive.google.com/file/d/19PQgA5jhDs0mC8AK8RvCtapFFUV1F9R-/view

https://mb.com.ph/2025/12/08/who-wants-to-pay-14kwh-for-offshore-wind

https://solaren-power.com/solar-energy-philippines-future-of-energy

https://mb.com.ph/2025/12/12/erc-sets-new-power-fee-at-00371kwh-to-fund-renewable-projects

https://www.pna.gov.ph/articles/1227172

https://world-nuclear.org/information-library/country-profiles/countries-o-s/philippines

https://legacy.senate.gov.ph/press_release/2025/0928_cayetanoa2.asp

https://www.pna.gov.ph/index.php/articles/1234940

https://pia.gov.ph/press-release/over-70-of-filipinos-back-nuclear-energy-as-power-for-the-future