Table of Contents

The Philippine energy sector entered 2025 at a pivotal inflection point: continuing to balance economic growth and energy security while advancing clean energy transition goals.

As demand surges with rapid economic and population growth, policymakers, investors, and civil society have grappled with complex trade-offs in policy and practice. These include coal’s continuing dominance despite climate commitments, nascent offshore wind ambitions, distribution challenges among rural electric cooperatives, and evolving market reforms.

Below are the top 10 energy highlights that shaped the Philippines in 2025, with analysis and verified sources.

- Renewable energy (RE) gains momentum

In 2025, RE gained clear momentum, with strong capacity growth and heightened investor interest shaping the year. A major milestone was the Fourth Green Energy Auction (GEA-4), which offered more than 10,400 megawatts (MW) of renewable and storage capacity, covering solar, onshore wind, floating solar, and solar projects paired with battery energy storage systems (BESS). This wasthe first time that storage was formally integrated into a national auction, a move designed to strengthen grid reliability while supporting rising electricity demand.

Developer response was robust. Over 9,400 MW of capacity was subscribed against a target of 10,653 MW, reflecting sustained private sector appetite for clean energy investments. Winning bidders secured large allocations for projects across Luzon, Visayas, and Mindanao, underscoring the nationwide scale of renewable development rather than its concentration in a single region.

One of the year’s most significant project completions was Citicore Solar Batangas 1, a 197 MW solar facility coupled with a 320 megawatt-hour (MWh) BESS. The project demonstrated how solar combined with storage can deliver round-the-clock power, effectively functioning as a baseload-capable renewable plant and setting a benchmark for future developments.

International collaboration was also strengthened. A strategic partnership between the Department of Energy (DOE) and Masdar outlined plans for up to 1 gigawatt (GW) of solar, wind, and battery projects by 2030, with potential expansion to 10 GW by 2035.

(Also read: Lighting Lifelines: How Solar Energy Is Transforming Hospitals Across Basilan and BARMM)

- Policy framework & foreign investment

A central reform has been the GEA program, which replaced the old feed-in tariff system with competitive auctions for renewable capacity. Since its launch, the program has held multiple rounds (GEA-1 through GEA-4 and now GEA-5), each progressively expanding the types of technologies eligible and allocating long-term contracts.

Issued in 2022, the amended implementing rules and regulations of the Renewable Energy Act of 2008 fundamentally changed the business landscape by lifting the long-standing40 % foreign ownership cap on RE ventures. The reform allowed up to100 % foreign ownership, opening the sector to wholly foreign capital and technical expertise.

As a result, the Board of Investments (BOI) recorded a record-breaking₱1.35 trillion in approved investments, with approximately95 % attributable to RE projects in 2024.

By May 2025, the Philippines’ RE sector had emerged as a clear driver of strategic investment, with the Board of Investments (BOI) granting Green Lane status to 208 projects, nearly 80% of which were renewable ventures valued at around ₱5.2 trillion.

The Green Lane program,designed to fast-track investments aligned with national development priorities, has helped propel a broader surge in capital inflows, contributing to a70% increase in approved investments under the Marcos administration.

Additionally, the Marcos administration increased support for the country’s RE development program in 2025. The General Appropriations Act for the year allocated ₱155.7 million to strengthen the DOE’s RE initiatives, reflecting an 8.4% rise from the ₱143.65 million set aside in 2024.

- Coal is still key to energy and growth

Philippine energy policy discussions reaffirmed coal’s central role in maintaining energy security and supporting economic growth — even as RE and gas alternatives expand.

According to the International Energy Agency (IEA), the Philippines’ coal consumption was forecast to reach an estimated 47 million tons in 2025 and rise to 54 million tons by 2030, underscoring coal’s dominance in power generation well into the next decade. Coal stillprovided roughly63% of the country’s electricity amid steady demand growth, with renewables contributing only about 22% of the mix.

Officials emphasize this reality. DOE Secretary Sharon Garin noted that “coal is always there… the most expensive electricity is no electricity at all. We can’t afford to have that in our country.”

In 2025, the DOE updated its coal moratorium policy to include a set of exceptions that allow new and expanded coal-fired power projects under specific conditions.

The revised advisory clarifies that new on‑grid coal capacity may be allowed “solely under exceptional circumstances, such as during a declared or imminent power crisis”, or when there is an imminent shortage of electricity supply, while self‑generating facilities in industrial parks, off‑grid projects, and plants supporting critical mineral processing for energy transition are explicitly exempt from the moratorium’s coverage.

Developers in these categories can secure a letter of acknowledgment of non‑coverage from the DOE to proceed, though they are required to register and include time‑bound transition plans to cleaner energy, with retirement or fuel conversion by Dec. 31, 2060, at the latest.

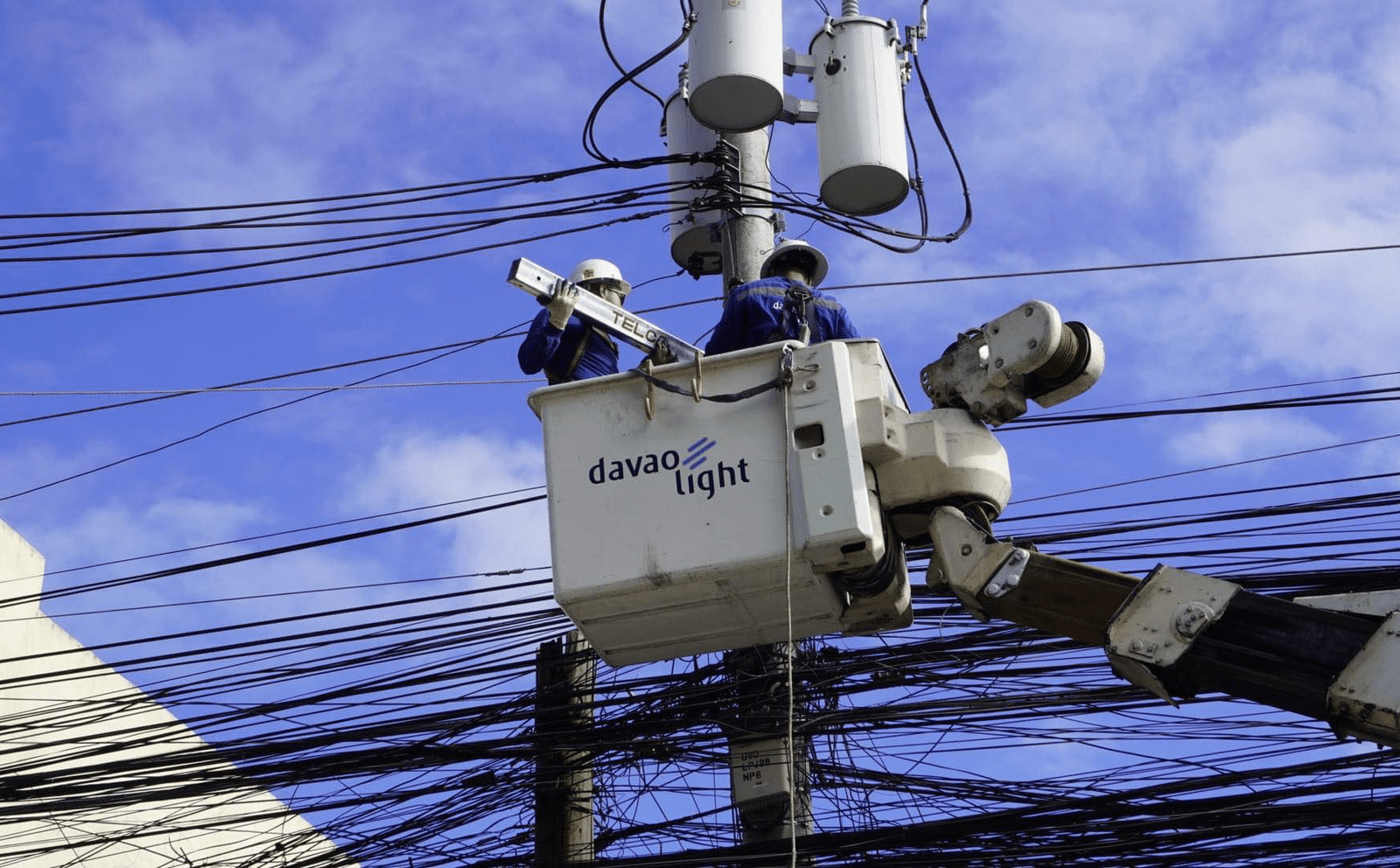

- Poor performance of electric cooperatives (ECs)

ECs across several regions struggled with reliability and service quality, leading to prolonged outages and growing public discontent.

In Aklan, the Aklan Electric Cooperative (Akelco) faced repeated unplanned power interruptions late in the year after high‑tide waves battered its temporary 69‑kilovolt (kV) bypass line, causing multi‑day outages that affected Boracay, Malay, and Buruanga towns and frustrated residents and tourists alike. Repair efforts were repeatedly slowed by environmental conditions, highlighting infrastructure vulnerability in this tourist‑dependent region.

In Siquijor, chronic outages in June prompted a state of calamity declaration as 5-hour daily brownouts plagued the off‑grid island. The Siquijor Island Power Corporation (SIPCOR) failed to fully meet the province’s10.51 MW, forcing reliance on rented generators and external support to stabilize the power supply.

By August, the Energy Regulatory Commission (ERC) revoked SIPCOR’s permit to operate, citing prolonged outages, poor maintenance, and regulatory non‑compliance. Earlier, the ERC also noted “operational and regulatory deficiencies” in the Province of Siquijor Electric Cooperative’s (Prosielco) distribution systems.

Cebu also saw significant disruptions after a powerful October earthquake tripped multiple power plants. The Visayas power grid was placed under a yellow alert for eight hours, as the earthquake disrupted service across 24 ECS. According to the National Electrification Administration (NEA), more than 800,000 consumer connections across the region experienced blackouts during this period.

The Cebu Electricity Rights Advocates (CERA) called on the government and energy sector to fast-track upgrades to the country’s power infrastructure after the Cebu Electric Cooperative (CEBECO) reported that 60% of its service area was without or had limited electricity following the recent earthquake.

CERAwarned that submarine cables connecting the islands remain vulnerable to earthquakes and typhoons. “The Philippines’ exposure to frequent natural disasters demands a resilient and disaster-ready energy system,” the group said.

In Mindanao, the Northern Davao Electric Cooperative (Nordeco) was suspended from the Wholesale Electricity Spot Market (WESM)in September over unpaid settlements totaling ₱337.6 million, raising concerns about its ability to secure sufficient supply and meet peak demand. Consumer groups criticized Nordeco’s silence and lack of transparency.

(Also read: Davao Light Prepares for Transition Amid Court Delay)

- Wholesale Electricity Market reforms and competition

Regulators and industry stakeholders continued to refine the Wholesale Electricity Spot Market (WESM) and related mechanisms to improve price discovery, competition, and responsiveness in power trading.

According to the DOE, enhancements in WESM operations — alongside initiatives like the Retail Competition and Open Access (RCOA) and Retail Aggregation Program (RAP) — are helping build a more efficient and competitive electricity market that offers better price signals and greater customer choice among retail electricity suppliers.

By mid-2025, total installed capacity in the country crossed 31,700 MW, with dependable capacity of nearly 27,800 MW and a deep pipeline of committed and indicative projects. These figures reflect a power landscape with broader supply options that market participants can tap, reinforcing WESM’s role as an arena where generation and demand interact more transparently.

At the same time, regulators have adjusted market rules, including secondary price cap thresholds, to balance competitive pricing with market stability during volatility.

Under the revised framework, additional compensation under the price cap is limited to oil-based and liquefied natural gas (LNG) power plants, and only when their verified fuel and variable operating costs exceed the ceiling. Other generation technologies are excluded, as the ERC found their marginal costs to be substantially lower, making them ineligible for extra payments.

- Higher electricity prices ahead

Consumers were warned of higher power bills in the near future as regulators introduce new charges tied to the GEA program.

In December 2025, the ERC approved the collection of a Green Energy Auction Allowance (GEA‑All) of ₱0.0371 per kilowatt‑hour (kWh), a separate line item that will appear on on‑grid electricity bills starting January 2026. The fee is designed to fund the differential payments owed to RE generators awarded contracts under rounds of the GEA, including previous and recent auctions for solar, wind, hydro, and integrated energy systems.

TransCo, the administrator of the GEA‑All fund, will collect the surcharge from distribution utilities, retail electricity suppliers, and the National Grid Corporation of the Philippines (NGCP) for direct customers, with proceeds remitted to long‑term renewable projects.

Consumer advocates and energy commentators have expressed concern that, while the surcharge is small on a per‑kWh basis, it adds to other regulatory charges and could contribute to higher overall electricity costs before the new renewable capacity comes fully online.

Nic Satur, Jr, chief advocate officer of the Partners for Affordable and Reliable Energy (PARE), said, “PARE supports the country’s shift to clean and renewable energy (RE), but these measures should move the Philippines toward a just, affordable, and participatory energy transition, not create new financial burdens for consumers.”

- Environmental groups’ protests

Several environmental and community groups in the Philippines voiced strong opposition not only to fossil fuel projects but also to certain renewable energy developments, which they argue threaten sensitive ecosystems, cultural heritage, and local rights.

One of the most high‑profile flashpoints was the proposed Banahaw Wind Power Project in Quezon Province. Resident coalitions and advocacy networks such as the Save Bundok Banahaw condemned the plan to erect 247 MW of wind turbines near Mount Banahaw, a legally protected landscape and sacred site ,citing concerns about ecological damage, loss of watershed services, threats to biodiversity, and potential harm to community livelihoods.

In Ilocos Norte, fisherfolk and national advocacy groups such as Pambansang Lakas ng Kilusang Mamamalakaya ng Pilipinas (PAMALAKAYA)strongly opposed the proposed BuhaWind Offshore Wind Farm, a 2,000‑MW project planned off the northern coast. Protesters warned the enormous wind farm would restrict access to traditional fishing grounds, displace thousands of small‑scale fishers in towns including Pasuquin, Burgos, Bangui, and Pagudpud, and disrupt marine ecosystems through noise, habitat loss, and restricted zones.

In Samar’s Calbayog City, residents, church groups, and civil society organizations mobilized against a planned onshore wind turbine project slated for forested, protected, and watershed areas. They organized a signature campaign and protest march, arguing that public consultation had been inadequate and that turbine construction could degrade the watershed, violating the area’s protected status.

- Offshore wind’s (OSW) questionable viability

In 2025, the country took a bold step toward harnessing OSW energy with the launch of GEA‑5,dedicated to fixed‑bottom OSW with a target of 3,300 MW for delivery by 2028 to 2030. The DOE has promoted OSW as a scalable, large‑capacity renewable source that could help meet long‑term energy and climate goals.

Despite this policy push, critics argue that OSW’s viability in the Philippine context remains deeply uncertain. A key hurdle is cost competitiveness. Studies indicate that OSW tariffs could be significantly higher than onshore renewables, with estimates suggesting tariffs could range from roughly ₱9.1 to ₱16.4 per kWh —four times more than solar PV — making it harder to compete for offtake contracts with distribution utilities or in the WESM.

Logistical and infrastructure constraints also weigh heavily. The Philippines lacks adequate OSW‑ready ports and supply chain infrastructure, potentially delaying project timelines and increasing costs, while specialized construction and marine engineering requirements add complexity and risk. Developers face financing challenges and high upfront capital costs, compounded by supply chain bottlenecks and limited local technical expertise.

Environmental and community concerns add additional friction, as turbine installations and subsea cabling may impact fishing grounds, marine habitats, and maritime navigation if not carefully planned.

- Focusing on rural electrification

In 2025, rural electrification remained a central focus of Philippine energy policy, aimed at closing the remaining access gap and bringing power to remote and underserved communities.

The NEA reported marked progress in its year-end review, highlighting sustained last-mile electrification projects, expanded solar systems for off-grid schools, and efforts to strengthen power delivery in island and geographically isolated areas despite challenges like natural disasters and supply constraints. NEA Administrator Antonio Mariano Almeda stressed the importance of reliable service delivery as the core of the administration’s rural agenda.

Government support for rural electrification also included significant budget releases, with the Department of Budget and Management (DBM) allocating over ₱3.6 billion in 2025 to energize more than 1,700 sitios and five barangays under the Rural Electrification Program.

Moreover, the DOE targeted the energization of about 5,000 additional households and expanded microgrid and solar home system deployments in hard-to-reach areas, including Quezon, Palawan, Masbate, Negros Occidental, and Zamboanga del Sur.

By late 2025, the electrification rate was on pace for nearly 92%, with NEA projecting further gains toward 94% by the end of 2026 and full nationwide access by 2028.

- Nuclear energy developments

The country made notable moves toward integrating nuclear power into its long-term energy strategy, signaling a renewed policy focus on this low-carbon, baseload generation option amid rising demand and climate goals.

A major milestone came in October 2025 when the DOE issued a comprehensive nuclear framework establishing the policy foundations for the country’s first commercially developed and operated nuclear power plant, called the Pioneer NPP.

The circular grants this project priority dispatch and introduces flexible contracting options to make nuclear investment more attractive for developers and investors. It also mandates coordinated grid readiness planning with system operators to allow seamless integration of nuclear capacity.

2025 also saw progress on the regulatory and institutional front. The Philippine Atomic Energy Regulatory Authority (PhilATOM) was established under the Philippine National Nuclear Energy Safety Act, giving the country its first independent nuclear regulator to oversee safety, security, and safeguards.

Private sector interest grew alongside government action. Manila Electric Company (Meralco) advanced its Nuclear Energy Strategic Transition (NEST) program, signing partnerships with South Korean institutions to build local nuclear expertise and explore small modular reactors (SMRs) as part of its long-range energy planning. These engagements include sending Filipino engineers abroad for specialized training and studying SMR feasibility for off-grid and distributed applications.

A sector in transition

2025 highlighted the Philippines’ dual challenge of maintaining energy security and supporting economic growth while advancing a clean and resilient energy transition. Coal continues to play a central role in powering key economic hubs and emerging regions, with moratorium exemptions reflecting its strategic importance. Renewables, particularly solar and nascent offshore wind, bring promise, strengthened by policy reforms and international support, though practical deployment challenges remain.

The sector’s progress will depend on effective regulatory governance, strategic investments in grid and storage, and efforts to modernize rural distribution utilities. Policymakers and stakeholders must continue navigating these trade-offs to ensure both economic vitality and climate commitments, positioning the Philippines for a sustainable and reliable energy future.

Sources:

https://tribune.net.ph/2025/09/05/smc-citicore-sweep-does-4th-green-auction

https://qa.philstar.com/headlines/2025/09/16/2473190/philippines-first-baseload-solar-farm-launched

https://mb.com.ph/2022/11/16/doe-opens-re-for-full-foreign-ownership

https://www.philstar.com/business/2026/01/02/2498140/philippines-coal-demand-seen-growing-15-2030

https://www.philstar.com/nation/2025/10/02/2476896/visayas-grid-yellow-alert-quake-hits-cebu

https://www.sunstar.com.ph/davao/group-slams-nordeco-over-wesm-suspension

https://businessmirror.com.ph/2025/10/09/reforms-spur-competition-in-phl-energy-sector

https://ndfp.info/quezonians-condemn-construction-of-wind-project-on-mount-banahaw

https://legacy.doe.gov.ph/press-releases/doe-kicks-green-energy-auction-fixed-bottom-offshore-wind

https://www.gwec.net/reports/financing-offshore-wind-in-the-philippines-risk-sharing-mechanisms

https://mb.com.ph/2025/12/08/who-wants-to-pay-14kwh-for-offshore-wind

https://en.wikipedia.org/wiki/Philippine_Atomic_Energy_Regulatory_Authority