Table of Contents

In its recent report, Integrating Solar and Wind in Southeast Asia, the International Energy Agency (IEA) examines Southeast Asia’s (SEA) surging electricity demand, driven by fast urban growth, economic expansion, and rising populations. “With rapidly rising electricity demand, there is a narrow but vital window to shape a secure, affordable and sustainable energy future,” the report stated.

The IEA highlights that eight of the ten ASEAN countries have committed to net-zero or carbon-neutral goals. Solar PV and wind, now among the “most cost-competitive electricity sources in the region,” could play a leading role in meeting these targets.

(Also read: Critical by 2026: Panay’s Electricity Demand Outpacing Supply)

5 key insights on SEA renewables

Exploring Southeast Asia’s renewable future, the IEA reveals top takeaways on integrating solar and wind.

- Soaring electricity demand

IEA insight: SEA is experiencing some of the fastest electricity demand growth in the world, with consumption expected to double by 2050. Rapid urbanization, population growth, industrial expansion, and rising living standards pushed demand up to over 7% in 2024, nearly twice the global average. This rapid rise highlights the urgent need for countries in the region to diversify their energy mix and secure reliable, resilient power supplies.

Reality check: Rising energy use is a natural feature of economic growth, but transitioning to low-carbon power remains complex. Countries fast-tracking green energy are already facing strain. In 2024, the UK retired its last coal plant, entering a coal-free era. However, experts warned that a system dominated by intermittent renewables is less flexible and more costly. Currently, the country is experiencing job losses and weakening industries, with Oxford economist Dieter Helm arguing that wind and solar alone cannot reliably meet a modern economy’s firm power needs. “Some wind and some solar have roles to play, but not the leading roles,” he asserted.

- Massive untapped solar & wind potential

IEA insight: With abundant renewable resources and one of the world’s fastest-growing electricity demands, second only to India, SEA faces critical choices to secure a sustainable energy future. Between 2000 and 2023, the share of renewables in the region’s electricity mix nearly tripled, with variable RE showing rapid growth. The technical potential for utility-scale solar PV and onshore and offshore wind exceeds 20 terawatts (TW), more than 50 times the current generation of 361 gigawatts (GW), of which only 40 GW comes from solar and wind. Even a fraction of this potential could diversify the energy mix and strengthen domestic production.

Reality check: Despite Southeast Asia’s enormous solar‑wind potential, abundant capacity doesn’t automatically ensure a reliable electricity supply. In Germany, a leading renewables market, dunkelflaute (periods of very low wind and solar output) events expose major risks. During periods of very low wind and solar in November–December 2024, wholesale electricity prices temporarily peaked at over €900/MWh. In early 2025, weak renewables output drove a 5.5% jump in energy consumption, with fossil fuels stepping in to meet demand.

- Cost-competitiveness

IEA insight: Variable RE, particularly solar and wind, is becoming a cornerstone of SEA’s power sector, thanks to rapidly falling costs. Since 2010, solar PV prices have dropped by roughly 90%, making both solar and wind among the cheapest options for new electricity generation.

Reality check: In the same report, the IEA cautions that variable RE will remain affordable only if countries invest early in stronger, modernized grids. The agency notes that meeting global climate pledges would require grid investments to double by 2035. Regional cooperation is equally vital: initiatives like the ASEAN Power Grid show how cross-border links can smooth renewable variability, share reserves, and lower overall costs.

The Netherlands reflects the grid dilemma as a surge in RE outpaces the nation’s ability to expand and modernize its infrastructure. Belgian energy expert Damien Ernst warned that years of underinvestment have left the country with widespread bottlenecks that could take billions and several years to resolve. The strain is already visible: the NL Times reported 27,341 power outages in 2024, a 17% increase over the five-year average, underscoring how rapid growth in clean energy can overwhelm grids that fail to keep pace.

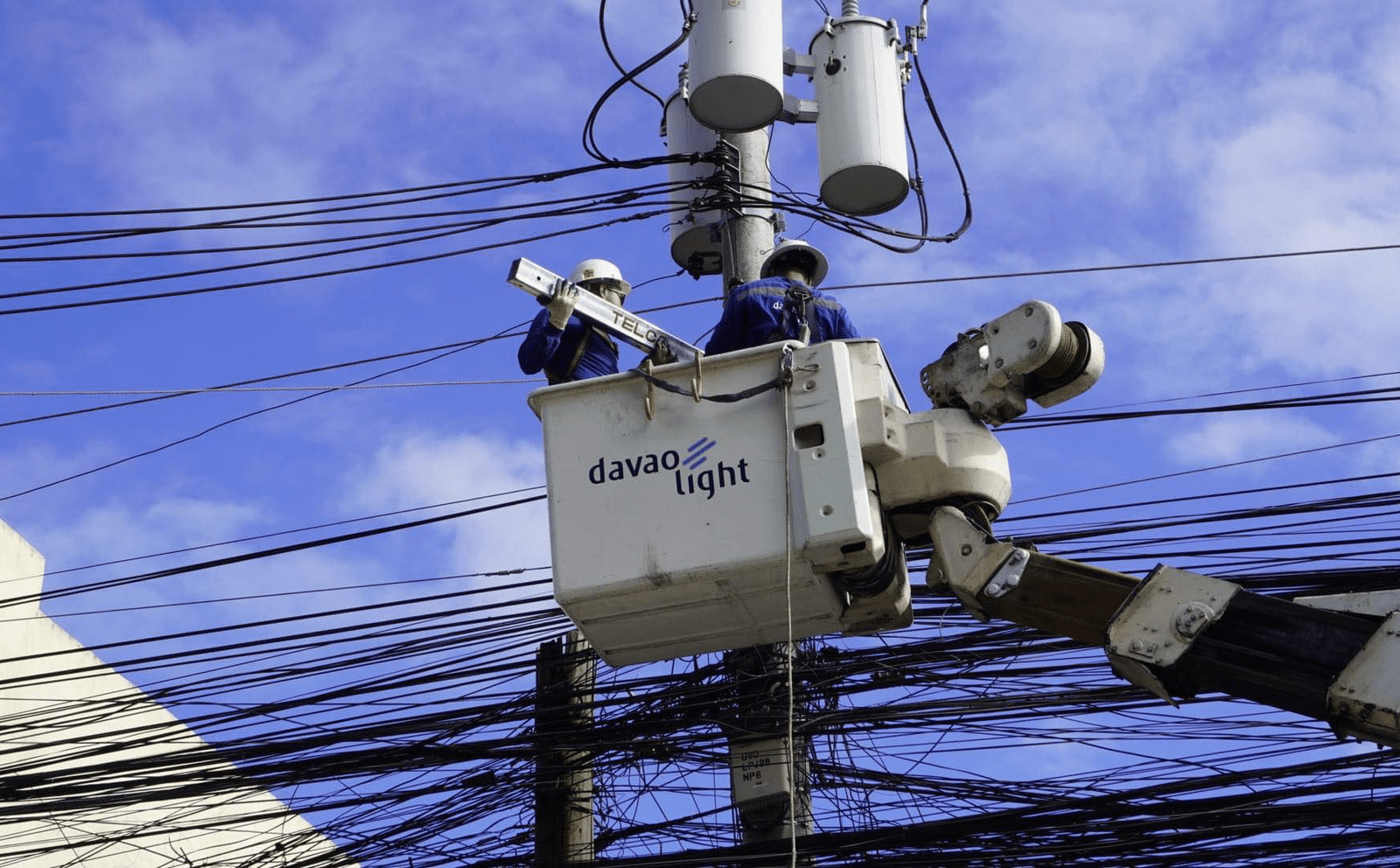

Additionally, the IEA acknowledges that archipelagic countries like the Philippines often rely on fragmented island grids with limited interconnections, making power balancing and efficient energy transmission more difficult.

- The Philippines’ high-readiness level

IEA insight: The Philippines is now considered one of the most prepared countries in the region for deeper power system transformation. This includes developing flexibility roadmaps, strengthening grid services, updating market and regulatory rules, and improving coordination across sectors. It is also the only SEA country expected to reach the higher readiness phases by 2035. Current energy plans indicate a significant scale-up of variable RE, with solar and wind projected to supply more than 30% of total generation within the next decade.

Reality check: Despite the Philippines’ promising renewable potential, several hurdles undercut its energy transition. Grid capacity remains constrained, with many green projects still waiting for system‐impact studies before connection. Moreover, the Department of Energy (DOE) has flagged 105 RE projects for delays, with most of them already canceled. Meanwhile, developers say local corruption persists, with officials demanding “facilitation” payments and steering them toward politically connected suppliers, adding delays, costs, and risk to RE projects. This shows that having projects on paper alone does not ensure progress; stronger governance is still needed to scale renewables.

- Coal’s dominance

IEA insight: ASEAN countries remain heavily reliant on coal and gas for power, with coal still supplying 47% of the region’s electricity in 2024. The average coal plant is just 15 years old, creating a dilemma between extracting economic value from existing assets and pursuing decarbonization goals. While some nations, like Indonesia, continue planning new coal capacity, falling costs for solar and wind make these long-term commitments increasingly risky. Policymakers are exploring options such as coal phase-outs, co-firing with renewables, and restrictions on new plants.

Reality check: IEA notes that as ASEAN integrates more solar and wind, stronger measures will be needed to keep power reliable and markets efficient. Coal and gas remain the backbone of flexibility, with hydropower providing additional support.

Japan illustrates coal’s ongoing role. In 2024, coal supplied 28% of electricity. During three-hour ramps, when demand swings sharply in just three hours, Shikoku’s coal plants boosted output by 26%. Such large ramps occurred at more than 20% of annual peak demand for 28% of the year, showing that even with renewables, reliable coal generation remains crucial.

(Also read: Slow Restorations Endanger Cebu’s Typhoon & Quake Victims)

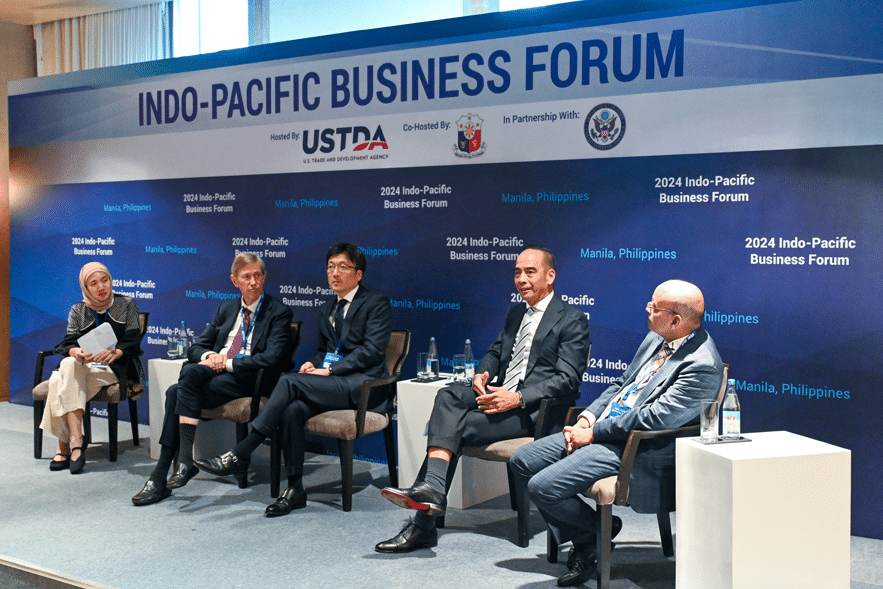

Practical path to green energy

The IEA paints an optimistic picture for renewable energy in SEA, yet the reality may be more complex. While forecasts show solar and wind supplying over half the region’s electricity by 2050, the agency also pointed out in a separate study that the weighted average cost of capital for projects remains high, such as 9.4% in Indonesia and 8% in the Philippines, well above the 5 to 6.5% levels in advanced economies. This raises questions about whether variable renewables can scale without heavy financing burdens and added risk.

The agency also noted a limited pipeline of renewable projects, which constrains large-scale deployment. Without more active projects, justifying investment in grid upgrades or broader system reforms becomes difficult. Transmission bottlenecks in markets such as Vietnam and the Philippines could delay or limit new generation. The integration the IEA envisions may therefore prove more costly and complicated than headline figures suggest.

Finally, the forecasts depend heavily on government follow-through. The IEA assumes rapid policy reform, including updated grid codes, market structures, and demand-response measures, which can be politically challenging across diverse ASEAN states. Unless policies are implemented as planned, even the IEA’s pro-renewable scenarios may fall short of expectations, tempering the promise of the region’s green transition.

Sources:

https://www.iea.org/reports/integrating-solar-and-wind-in-southeast-asia

https://ember-energy.org/latest-insights/the-uks-journey-to-a-coal-power-phase-out

https://www.bundesnetzagentur.de/SharedDocs/Pressemitteilungen/EN/2025/20251021_Preisspitzen.html

https://www.bbc.com/news/articles/cn40y9yxkgvo

https://www.philstar.com/business/2025/08/03/2462636/doe-oks-17-re-projects-grid-impact-study

https://businessmirror.com.ph/2025/11/10/idle-re-contracts-shelved

https://www.rappler.com/voices/thought-leaders/vantage-point-why-green-energy-failing