Table of Contents

As the world shifts toward cleaner, sustainable energy, renewable energy policies have become crucial tools in guiding that transformation. Renewable energy policies are government and international initiatives that encourage the adoption of sources such as solar, wind, hydro, geothermal, and biomass. These policies provide the frameworks and incentives that aim to address challenges such as upfront costs, technology gaps, and inadequate infrastructure, which often limit the growth of renewable energy. Regulatory policies create certainty in the market, giving renewable energy projects a clear path to operation and expansion.

These policies come in various forms, each targeting specific objectives. Broadly, they fall into three categories: regulatory policies, financial incentives, and market-based mechanisms.

- Regulatory policies impose requirements, such as Renewable Portfolio Standards (RPS), which compel utilities to obtain a portion of their power from renewables.

- Financial incentives lower costs through tax breaks, rebates, grants, and feed-in tariffs that guarantee fixed prices for renewable energy.

- Market-based tools encourage clean energy by factoring in fossil fuel environmental costs through carbon pricing and renewable energy certificates (RECs).

Regulatory Policies: Setting the Rules and Standards

Regulatory policies are government mandates or legal requirements designed to promote renewable energy. Think of them as the “rules of the game” that utilities, companies, or consumers must follow.

Renewable Portfolio Standards (RPS) require electricity providers to source a set minimum percentage of their power from renewable sources by a certain deadline, creating stable demand to boost investment. They define eligible energy types, targets, and enforcement, sometimes including specific goals for technologies.

For example, a utility might be mandated to ensure that 20% of its electricity comes from solar, wind, or hydro by 2030. Effective RPS provide clear market signals, while poorly designed ones may raise costs and limit benefits.

(Also read: Your Power, Your Choice: Energy Market Reforms to Know)

Financial Incentives: Making Renewables More Affordable

Renewable energy projects often require significant upfront investment, which can be a barrier. Financial incentives help reduce the initial and ongoing costs of renewable energy, improving their competitiveness with traditional sources. These include tax credits, rebates, grants, and feed-in tariffs.

- Tax credits lower income taxes for those investing in renewables.

- Rebates provide direct payments for purchasing renewable equipment like solar panels or EVs.

- Grants offer upfront funding, especially for innovative projects or underserved areas.

- Feed-in tariffs (FITs) guarantee fixed prices for renewable energy supplied to the grid over a specified period, ensuring steady revenue. This stability encourages investment by assuring developers a predictable income.

The United States pioneered the feed-in tariff approach with the 1978 Public Utilities Regulatory Policies Act (PURPA), signed by President Carter. It required utilities to purchase power from renewable and cogeneration sources at the avoided cost rate. While most states set modest rates, California’s strong implementation helped spark early growth in renewables, influencing global adoption.

Well-designed incentives—targeted, transparent, and predictable—can significantly speed up renewable energy adoption, reduce financial risk, and lower costs.

(Also read: Millions of Green Jobs Expected as Clean Power Expands)

Market-Based Mechanisms: Using Market Forces to Drive Change

Market-based policies use economic incentives to support a shift towards cleaner energy. They create flexible, cost-effective ways to reduce carbon footprints while incentivizing renewable energy. Key examples include carbon pricing and renewable energy certificates (RECs).

- Carbon pricing: Putting a price on carbon emissions, either through a direct tax or a cap-and-trade system, makes polluting activities more expensive. This encourages businesses to reduce emissions and invest in renewables.

- Renewable Energy Certificates (RECs): These tradable certificates represent proof that a certain amount of electricity was generated from renewable sources. Utilities or companies buy RECs to meet renewable energy obligations or offset emissions.

Finland was the first country to implement a carbon tax in 1990, marking the start of market-driven climate action. Though the initial rate was low, it gradually increased, inspiring other countries to follow. Today, 23 European nations have introduced carbon taxes, with rates reflecting the estimated social cost of carbon.

(Also read: Integrating Renewable Energy: Challenges and Opportunities)

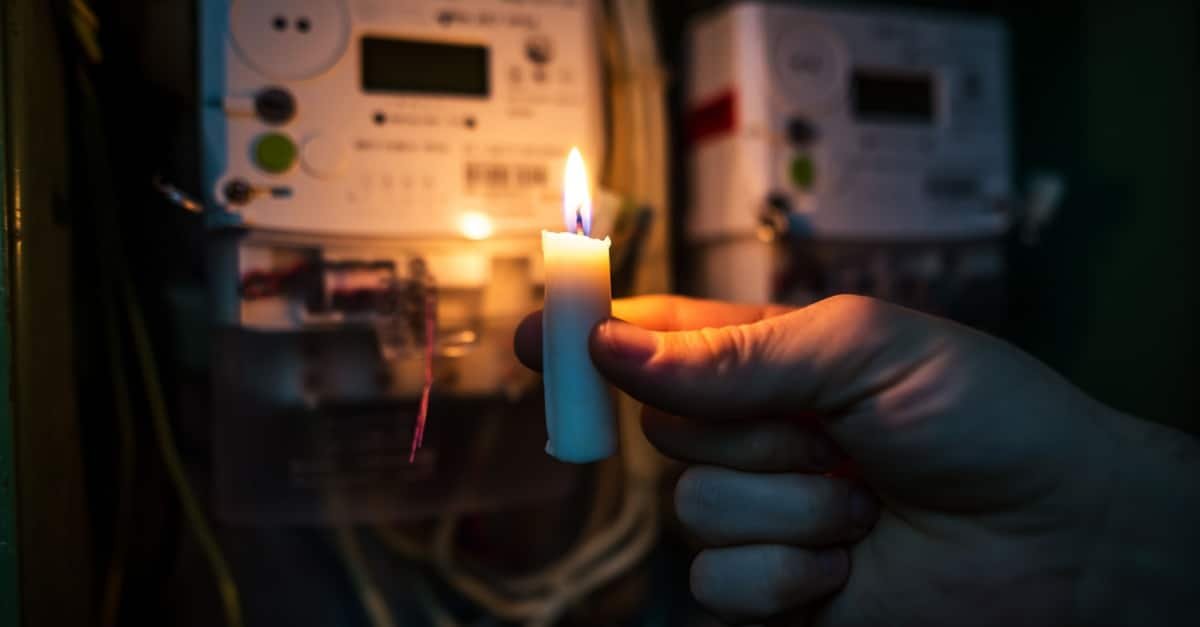

The Setback: Feed-in Tariffs are Not Free

Still, the renewable push is not without its costs. One example is the feed-in tariff (FIT), a policy that drives renewable energy investment by offering producers fixed, above-market rates under long-term contracts. The added cost, however, is passed on to consumers through surcharges on electricity bills, spreading the burden across all households and businesses.

Starting with the March 2025 billing cycle, the Philippines’ Energy Regulatory Commission (ERC) has approved raising the Feed-in Tariff Allowance (FIT-All) charge from ₱0.0838 per kilowatt-hour (kWh) to ₱0.1189/kWh, marking an approximate 42% increase. For an average household consuming 200 kWh per month, the reinstituted charge translates to approximately ₱7.28 extra on the monthly bill.

The increase aims to replenish the FIT-All Fund, which has been depleted due to sustained low prices in the Wholesale Electricity Spot Market (WESM). These low market prices reduced the fund’s capacity to cover payments to renewable energy producers under the FIT system.

Additionally, columnist Bienvenido Oplas warned that consumers may soon face a new Green Energy Auction Allowance (GEA-All) on top of existing charges like FIT-All. Unlike previous surcharges, this one could be far larger—potentially double or even quadruple the FIT-All—because of the sheer volume of solar and wind projects already approved with guaranteed high rates.

“The economic team, concerned with high inflation and its dampening effect on consumer spending and overall GDP growth, should warn the energy sector of the future economic sabotage of these ongoing moves,” urged Oplas.

Crafting Effective Policies for an Energy-Secure Future

Policy stability and long-term targets are essential to attracting investment and sustaining growth in the renewable energy sector. At the same time, governments must be ready to adjust policies as technologies mature and market conditions evolve. Policies must also promote social equity by ensuring that the benefits of clean energy reach low-income, indigenous, and marginalized communities.

Striking the right balance is critical: renewable incentives must spur clean energy growth without creating an unsustainable burden on consumers. Regulators need to ensure that subsidies remain transparent, proportionate, and time-bound, with clear exit strategies once technologies become competitive. Well-calibrated measures can drive investment, contain inflationary pressures, and secure affordable power for the long term.

Sources:

https://www.iea.org/policies/4531-green-power-renewable-portfolio-standards-rps

https://www.greentechmedia.com/articles/read/feed-in-tariffs-a-tool-for-us-economic-equality

https://www.iea.org/energy-system/renewables

https://unctad.org/system/files/official-document/dtlstict2019d2_en.pdf

https://en.wikipedia.org/wiki/Feed-in_tariff